FTX Crisis. What we know and some forecasts on what will happen next

By Nathan Young, NunoSempere, Stan van Wingerden, Juan Gil @ 2022-11-08T19:16 (+368)

Tl;dr:

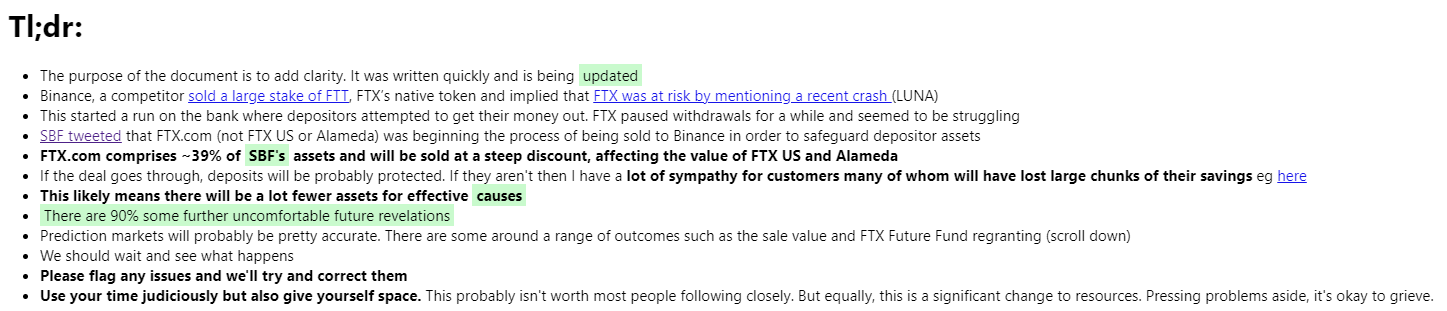

- The purpose of the document is to add clarity. It was written quickly and is being updated

- Binance, a competitor sold a large stake of FTT, FTX’s native token and implied that FTX was at risk by mentioning a recent crash (LUNA). This looks bad, but given what follows, the accusation was probably legitimate

- This started a run on the bank (FTX.com) where depositors attempted to get their money out.

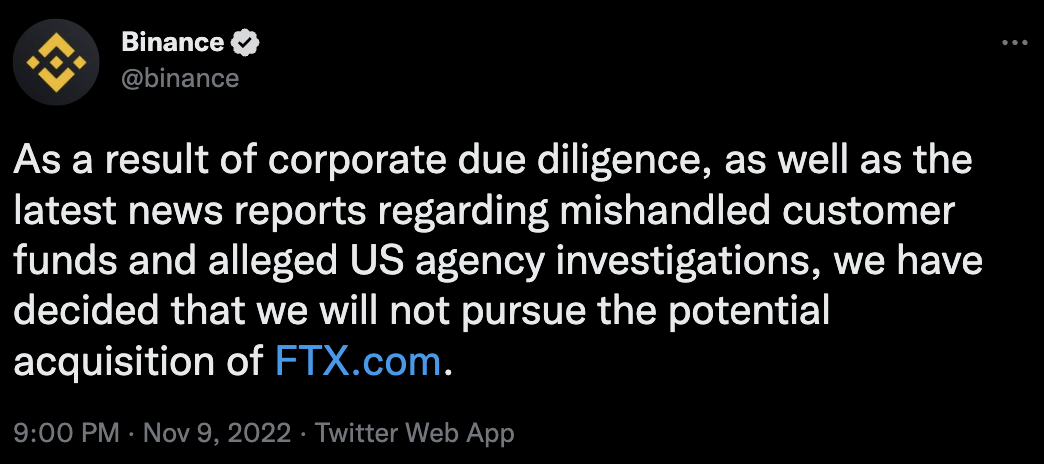

- SBF tweeted that FTX.com (not FTX US or Alameda) was beginning the process of being sold to Binance in order to safeguard depositor assets. Binance have since backed out of this and there are credible claims that funds customers deposited for safekeeping were being invested without their consent

- FTX.com comprises ~39% of SBF's assets and will likely be worthless (80%), probably FTX US (60%) will be too and probably Alameda also (85%).

- SBF is attempting to raise funds to cover deposits. He will almost certainly fail. ( ~90%)

- It is therefore very likely to lead to the loss of deposits which will hurt the lives of 10,000s of people eg here

- Regardless, this likely means there will be a lot fewer assets for effective causes

- There are some prediction markets below for things that are less clear

- We should wait and see what happens

- Please flag any issues and we'll try and correct them

- Use your time judiciously but also give yourself space. This probably isn't worth most people following closely. But equally, this is a significant change to resources and expectations are going to shift a lot. Pressing problems aside, it's okay to grieve.

Longer version

There are three key entities here (prices according to Bloomberg, so probably wrong):

- FTX (The worldwide business) that composes about 39%

- FTX.US (FTX’s US arm) a crypto exchange that composes about 13% of SBF’s wealth

- Alameda, a hedge fund which composes 46%

Alameda was SBF’s original hedge fund and made markets for FTX. The behaviour of the two was correlated, and Alameda held large positions in FTT, FTX’s token. It seems likely there were deep irregularities in FTX.com's finances also. Coindesk reported Alameda were in trouble, and some internal documents were leaked. Alameda CEO, Caroline Ellison rebutted.

Binance left/was pushed out of an early funding round of FTX and were paid in FTT, FTX’s native token. It seems like there was bad blood. This week Binance said they were selling their FTT and referenced LUNA a coin that recently crashed. It is common for projects in crypto to fail, so when there is a sense they will, people withdraw their money rapidly. This started a run on FTX. As above, given what follows their accusation was not without merit.

SBF announced that FTX.com, the non-US business, had been agreed in principle to be sold. SBF talks about that here. Binance have now backed out of the deal citing "news reports regarding mishandled customer funds". SBF is currently trying to raise money to cover these deposits. If he doesn't many depositors will likely lose their money, which will ruin 1000s of lives. This will also likely lead to fewer resources for effective causes which may ruin far more lives, now and in the future. Both of these outcomes are terrible.

This is hard to hear. It is 95% at this point that there was serious unethical behaviour. I can't comment on crime because I don't understand the law, but my (Nathan's) sense is that these will turn out to be things we think ought to be crimes. This is likely to be really bad for depositors. Many of these are covered in more detail in prediction markets below which will stay accurate (whereas this text will be updated more slowly).

Twitter threads

The thread announcing serious issues.

The most recent thread from Binance.

Claims of immoral activity (transferring users funds to risky assets without their consent) - the Reuters report is here.

SBF's latest thread (ht Greg Colbourn)

Relevant forecasts

Here is a section of relevant forecasts to try and give people a picture of what might happen.

The other key question is what happens to the FTX Foundation. How much will it spend next year? 66%

Will the FTX Future Fund spend more than $300mn in 2023? 15%

Will the FTX Future Fund spend more than $600mn in 2023? If this is high, then individuals may have more job security.

What will Forbes estimate SBF's wealth at?

Thoughts on financial details (suggest in comments)

- OpenPhil

- $3 - 6 Bn 80% CI

- Dustin/Cari

- $6 - 10 Bn 80% CI

- FTX Foundation & Future Fund

- Founders Pledge

Final comments

- This is gonna get worse before it gets better

- In general, it's probably good to wait before making judgements, but also to seek to have clarity where it affects decisions.

Kyle Lucchese @ 2022-11-08T22:25 (+208)

While this is all being sorted and we figure out what is next, I would like to emphasize wishes of wellness and care for the many impacted by this.

Note: The original post was edited to clarify the need for compassion and to remove anything resembling “tribalism,” including a comment of thanks, which may be referenced in comments.

richard_ngo @ 2022-11-09T21:22 (+175)

[Edit: this was in response to the original version of the parent comment, not the new edited version]

Strong -1, the last line in particular seems deeply inappropriate given the live possibility that these events were caused by large-scale fraud on the part of FTX, and I'm disappointed that so many people endorsed it. (Maybe because the reasons to suspect fraud weren't flagged in original post?) At a point where the integrity of leading figures in the movement has been called into question, it is particularly important that we hold ourselves to high standards rather than reflexively falling back on tribalist instincts.

Nathan Young @ 2022-11-09T22:33 (+61)

Several people, including you, told me not to post this initially. To me that felt like "we should not do thing that damage FTX's chances in an involving situation". I'm not accusing, just confused - it feels hard to square that with this reply.

richard_ngo @ 2022-11-10T01:29 (+57)

My preferences here are that people (and in particular the EA community):

- Don't support (what could potentially be) fraud.

- Don't exacerbate bank runs by making overly strong claims about likelihood of bad outcomes (whether or not there is underlying fraud - either way expectations of collapse can be self-fulfilling).

- (Less important) Remain careful about epistemics (e.g. avoid making big claims about impacts on long-term strategy from a state of severe uncertainty).

And then, subject to the constraints above, I'd like people to be as well-informed as possible. I think that these are pretty reasonable preferences and that I've behaved consistently with them.

Agrippa @ 2022-11-10T06:27 (+24)

I really take issue with #2 here. Bank run exacerbation saved my friend's life savings. Expectations of collapse can save your life if, you know, there's a collapse.

It really seems insanely cruel to say we shouldn't inform people because it might be bad for FTX (namely in the event of insolvency). Where are our priorities? I'm very glad that my friends did not observe your #2 preference here.

Of course the best way to help FTX against a bank run would have been to deposit your own funds at the first sign of distress. As of writing I think it's still not too late!

berglund @ 2022-11-10T15:45 (+9)

Maybe I'm misunderstanding bank runs, but as I understand it, they happen because

- the institution that is holding other people's money doesn't have all that money in liquid form

- they are unable to give it back if everybody tries to deposit it at once

- when this happens, the institution runs out of money and many people, who didn't withdraw their cash in time, lose all their deposits

I think the reason Richard listed #2 as a preference is that there might still be hope that FTX doesn't run out of money in the first place and no one loses their deposits.

However, it might be FTX will run out of money either way. In that case, speeding up the bank run will lead some people to get more their money back, but only because they pick it up before other people do. In the end it's a zero-sum game, because FTX only has a limited amount of liquid currency. If my model is correct, then there is no net benefit in speeding up the bank run.

Agrippa @ 2022-11-10T17:32 (+8)

I would like to be involved in the version of EAs where we look after eachother's basic wellness even if it's bad for FTX or other FTX depositors. I think people will find this version of EA more emotionally safe and inspiring.

To me there is just no normative difference between trying to suppress information and actively telling people they should go deposit on FTX when distress occurred (without communicating any risks involved), knowing that there was a good chance they'd get totally boned if they did so. Under your model this would be no net detriment, but it would also just be sociopathic.

Yes the version of EA where people suppress this information, rather than actively promote deposits, is safer. But both are quite cruel and not something I could earnestly suggest to a friend that they devote their lives to.

berglund @ 2022-11-10T18:44 (+24)

Hm, yeah I guess my intuition is the opposite. To me, one of the central parts of effective altruism is that it's impartial, meaning we shouldn't put some people's welfare over other's.

I think in this case it's particularly important to be impartial, because EA is a group of people that benefitted a lot from FTX, so it seems wrong for us to try to transfer the harms it is now causing onto other people.

Agrippa @ 2022-11-11T11:01 (+3)

(as an aside it also seems quite unusual to apply this impartiality to the finances of EAs. If EAs were going to be financially impartial it seems like we would not really encourage trying to earn money in competitive financially zero sum ways such as a quant finance career or crypto trading)

Agrippa @ 2022-11-11T10:41 (+1)

Aspiring to be impartially altruistic doesn't mean we should shank eachother. The so-impartial-we-will-harvest-your-organs-and-steal-your-money version of EA has no future as a grassroots movement or even room to grow as far as I can tell.

This community norm strategy works if you determine that retaining socioeconomically normal people doesn't actually matter and you just want to incubate billionaires, but I guess we have to hope the next billionare is not so (allegedly) impartial towards their users' welfare.

Agrippa @ 2022-11-11T10:49 (+19)

Seriously, imagine dedicating your life to EA and then finding out you lost your life savings because one group of EAs defrauded you and the other top EAs decided you shouldn't be alerted about it for as long as possible specifically because it might lead to you reaching safety. Of course none of the in-the-know people decided to put up their own money to defend against bank run, just decided it would be best if you kept doing so.

In that situation I have to say I would just go and never look back.

Ozzie Gooen @ 2022-11-09T22:24 (+41)

Personally, when I first saw the news, I really wasn't expecting fraud.

At this point, the recent news hasn't been looking good, and it seems like a possibility.

If it comes out there was fraud and the team did illegal activity, then that should clearly be taken seriously.

Neel Nanda @ 2022-11-09T22:47 (+12)

+1 on both counts, developments today have definitely shifted my guesses for what happened, though I'm overall just pretty confused and uncertain!

freedomandutility @ 2022-11-10T09:19 (+7)

I hope CEA are looking at how to protect EA’s reputation from this.

I always thought it was a bad idea for SBF to try to make himself the face of EA.

Ozzie Gooen @ 2022-11-10T14:54 (+27)

I strongly expect them to be. This situation is looking a lot like a disaster for EA. The leaders of EA orgs should be taking this very seriously, especialy the main EA orgs.

I'd expect to see a bunch of press releases and blog posts in the next 1-2 weeks or so.

Sharmake @ 2022-11-09T21:48 (+17)

Question, but why is it bad to wish well on people impacted by this? I get it, there's a whole lot of rumors about fraud, but why is even the very basic norm of wishing well viewed as a bad thing?

emre kaplan @ 2022-11-09T21:50 (+20)

I think the comment was edited after this reply and the sentence referred was deleted.

Kyle Lucchese @ 2022-11-09T22:26 (+11)

This is true. My original comment has been edited to clarify my intent (as was later mentioned in a reply). The reference to thanks did more to confuse than to support. My apologies for the confusion.

As for the allegations of large-scale fraud: Yes, you're correct that the situation has evolved several times, hence the numerous rephrases. Though, I am currently uncertain regarding whether fraud actually occurred. That said, I certainly agree that we should hold people to a high standard of ethical conduct.

peterhartree @ 2022-11-09T12:03 (+109)

I am worried and sad for all involved, but I am especially concerned for the wellbeing and prospects of the ~millions of people—often vulnerable retail investors—who may have taken on too much exposure to crypto in general.

Many people like this must be extremely stressed right now. As with many financial meltdowns, some individuals and families will endure severe hardship, such as the breakdown of relationships, the loss of life savings, even the death of loved ones.

I don't really follow crypto so I know roughly nothing about the role SBF, FTX and Alameda have played in this ecosystem. My impression is that they've been ok/good on at least some dimensions of protecting vulnerable investors. But—let's see how things look, overall, when the dust settles.

Persona14246 @ 2022-11-09T20:30 (+33)

At this point, it is very clear that they have not been "good" and it is in fact the exact opposite. It is very likely that billions of dollars of user deposits are now zeroed and the equity investments of all their investors in FTX are likely worth zero as well, and it isn't because of a mistake but because of wildly irresponsible and most likely fraudulent and criminal actions on behalf of FTX, Alameda, and Sam. They are being investigated by both the SEC , the CFTC and the DOJ; Binance is walking away from any sort of takeover. My heart goes out to the users and the teams of these companies but this is egregious and one of the worst events to transpire within crypto ever.

Sabs @ 2022-11-09T12:39 (+23)

I sort of suspect that they were not, in fact, exemplary on any definitions of protecting retail investors at any point. The whole point of FTX was to offer leverage to its users! It was the derivatives exchange where you could get margin! This is generally bad for retail! (and then maybe had Alameda trading against you, but hey).

This is all before their exchange suffered huge outflows and it turned out they didn't have customer funds protected at all. So no, at no point was this good for retail, it was incredibly predatory from beginning to end!

peterhartree @ 2022-11-09T13:14 (+7)

Thanks. I've changed "exemplary" to "ok/good" for a couple of reasons, partly due to your comment.

I don't understand the space well enough to properly engage this debate at the moment.

Greg_Colbourn @ 2022-11-09T15:24 (+9)

Peter, get back to work ;) (I know I should too!)

peterhartree @ 2022-11-09T17:13 (+6)

Haha, yep.

Neel Nanda @ 2022-11-08T23:10 (+63)

Strong +1, I imagine this is a very stressful time for all of them! I think they've all done an incredibly impressive amount of good already and wish them the best.

EDIT: I made this comment when my understanding of the situation was that FTX had experienced a liquidity crisis due to a bank run, and were going to be acquired by Binance (and customers made whole). I'm now a lot more confused about the situation, and what the appropriate emotional orientation to it/to FTX is.

keith_wynroe @ 2022-11-09T17:38 (+112)

I think it's very plausible the reputational damage to EA from this - if it's as bad as it's looking to be - will outweigh the good the Future Fund has done tbh

Agreed lots of kudos to the Future Fund people though

peterhartree @ 2022-11-09T05:14 (+194)

I think most people reading this thread should totally ignore this story for at least 2 weeks. Meantime: get back to work.

For >90% of readers, I suspect:

- It's not action relevant right now.

- It's very distracting.

- It would be better to just read a sober update on the situation in a couple of weeks from now, after dust has settled.

I think this is true even of most people who have a bunch of crypto and/or are FTX customers, but that's more debatable and depends on exposure.

These are the standard problems with following almost any BREAKING NEWS story (e.g. an election night, a stock market event, an ongoing tragedy).

Agree, but still find it hard to stop watching? You are glued to your screen and this is unhelpful. This is an opportunity to practice the skill of ignoring stuff that isn't action-relevant, and allocating your attention effectively.

Not actively trading crypto or related assets? Just ignore this story for a while, and get back to work.

Added 2022-11-09 2200 GMT:

If I had a good friend who has a lot of crypto and who may be concerned about losing more than they can afford to lose, I would call them.

Given what I'm seeing online, the situation looks grim for people with big exposure to crypto in general, and those with deposits at FTX in particular.

(To repeat what I said in other comments on this post: I don't follow crypto closely. My takes are not investment advice.)

Geoffrey Miller @ 2022-11-09T17:09 (+88)

Peter -- I have mixed feelings about your advice, which is well-expressed and reasonable.

I agree that, typically, it's prudent not to get caught up in news stories that involve high uncertainty, many rumors, and unclear long-term impact.

However, a crucial issue for the EA movement is whether there will be a big public relations blowback against EA from the FTX difficulties. If there's significant risk of this blowback, EA leadership better develop a pro-active plan for dealing with the PR crisis -- and quick.

The FTX crisis is a Very Big Deal in crypto -- one of the worst crises ever. Worldwide, about 300 million people own crypto. Most of them have seen dramatic losses in the value of their tokens recently. On paper, at least, they have lost a couple of hundred billion dollars in the last couple of days. Most investors are down at least 20% this week because of this crisis. Even if prices recover, we will never forget how massive this drop has been.

Sam Bankman-Fried (SBF) himself has allegedly lost about 94% of his net worth this week, down from $15 billion to under $1 billion. (I don't give much credence to these estimates, but it's pretty clear the losses have been very large).

Millions of crypto investors are furious. They blame the FTX leadership, especially SBF. And some of them are blaming FTX's difficulties on SBF's utilitarianism, e.g. tweeting things like 'never trust a utilitarian with your money'.

This could all blow over. The financial contagion from FTX might be contained. Crypto prices might recover soon. Binance dominating the crypto exchange space might become the new normal. Other billionaires might step up to fill any funding gap (once the asset markets recover in a year, or two, or five).

But I think it would be prudent for EA leadership to treat this FTX crisis as a potentially serious PR crisis for EA -- and not just a massive financial crisis for EA funding. SBF's close association with EA creates some potential PR risk for the EA movement, especially among crypto investors.

It all depends on how mainstream media spins the FTX story. The next couple of weeks will be critical. If crypto news, financial news, and/or mainstream news starts blaming SBF personally for these difficulties, or uncovers evidence of financial wrong-doing, or links the FTX crisis someone to utilitarian moral reasoning and/or EA, that could be really bad for our movement.

I have no idea what the optimal PR response would be. I'm not a PR expert. But PR crisis management experts do exist, and I would strongly urge EA leadership to consult some of them. Soon.

This FTX crisis might not be an existential risk to EA, but it might be a global catastrophic risk at both the financial and the public relations levels. And we have learned to take GCRs seriously, haven't we?

PS let me be clear: I have a lot of respect for SBF; I don't have any real idea what happened with FTX; I'm not assigning any blame; and I hope the crisis can be resolved with minimal damage to investors and the crypto industry.

peterhartree @ 2022-11-09T17:20 (+42)

If there's significant risk of this blowback, EA leadership better develop a pro-active plan for dealing with the PR crisis -- and quick.

I think it would be prudent for EA leadership to treat this FTX crisis as a potentially serious PR crisis for EA -- and not just a massive financial crisis for EA funding.

I've been talking to key people a fair bit since yesterday, broadly pushing the line and level of concern that you suggest. My current take is that the "pro-active plan" work is happening quickly and with appropriate investment.

Geoffrey Miller @ 2022-11-09T17:31 (+13)

Peter -- thanks very much for your quick reply. That's reassuring to hear!

John_Maxwell @ 2022-11-09T23:20 (+18)

Habryka @ 2022-11-09T05:34 (+85)

Hmm, I don't really buy this. I think at Lightcone I am likely to delay any major expenses for a few weeks and make decisions assuming a decent chance we will have a substantial funding crunch. We have a number of very large expenses coming up, and ignoring this would I think cause us to make substantially worse choices.

peterhartree @ 2022-11-09T10:26 (+48)

Yep, I would emphasise "most" in my post above.

My guess is that if we talked about specifically who should follow this, we'd end up agreeing that >90% of readers of this thread should largely ignore for now. I vaguely recall that some 5000 people read the forum every week.

I do think that one person from each major EA org should be following along, and providing regular updates to their team for reasons of morale and (e.g.) suggestions on how to approach social media and the enquiries from journalists that we might expect to receive.

I also think that one person (from CEA) should be point person on this and put together a small team to support them, consult stakeholders, etc, if necessary.

FWIW I called around a bit last night and my understanding is that there is a very competent "point person", and I am satisfied that they and the small group supporting them will help the community navigate this in a good/excellent way over the next days and weeks.

Back to work (nearly) everyone! :)

Ozzie Gooen @ 2022-11-09T05:59 (+40)

I'm in a similar boat. This has caused me to delay some sizeable spending decisions for 1-2 weeks.

I think the information is pretty useful to a handful of people, though I imagine that for most readers, it's not decision-relevant on a short timescale.

dumont @ 2022-11-09T06:31 (+37)

-

freedomandutility @ 2022-11-08T22:18 (+154)

Back to earning the give I guess, I’ll see you guys at the McKinsey office

berglund @ 2022-11-09T02:03 (+66)

Or better yet, at Y Combinator.

freedomandutility @ 2022-11-09T09:28 (+27)

Yeah while we’re here, can we focus more on start ups than high paying jobs this time https://forum.effectivealtruism.org/posts/JXDi8tL6uoKPhg4uw/earning-to-give-should-have-focused-more-on-entrepreneurship

DonyChristie @ 2022-11-09T19:40 (+3)

I haven't made this point publicly yet but as a throwaway comment I'll say that early on it was clear to me over a decade ago we should be incubating billionaires, though I also got pwned by the earn-to-give meme for a while after that.

BrownHairedEevee @ 2022-11-17T04:25 (+2)

Sounds like a job for Founders Pledge.

Right now, they focus on persuading entrepreneurs to donate their exit profits to effective charities. But what about the reverse: convincing EAs to become entrepreneurs?

projectionconfusion @ 2022-11-09T16:53 (+35)

Feels like it was a mistake to tell people to change their strategy if it can be reversed by a single donor having issues. All the emphasis on "we're not funding constrained" may have done long term harm by reducing future donations from a wider pool of people.

Linch @ 2022-11-09T21:34 (+12)

It's not just a single donor, tech stocks have been down across the board in 2022.

Evan_Gaensbauer @ 2022-11-09T06:30 (+27)

The question of to what extent more effective altruists should return to earning to give during the last year as the value of companies like Meta and FTX has declined has me pondering whether that's worthwhile, given how nobody in EA seems to know how to spend well way more money per year on multiple EA causes.

I've been meaning to write a post about how there has been a lot of mixed messaging about what to do about AI alignment. There has been an increased urgency to onboard new talent, and launch and expand projects, yet there is an apparently growing consensus that almost everything everyone is doing is either pointless or making things worse. Setbacks the clean meat industry faces have been mounting during the last couple years. There aren't clear or obvious ways to make significant progress on overcoming those setbacks mainly by throwing more money at them in some way.

I'm not as familiar with how much room for more funding before diminishing marginal returns are hit for other priority areas for EA. I expect that other than a few clear-cut cases like maybe some of Givewell's top recommended charities, there isn't a strong sense of how to spend well more money per year than a lot of causes are already receiving from the EA community.

It's one thing for smaller numbers of people returning to give to know the best targets for increased marginal funding that might fall through after the decline of FTX. It seems like it might be shortsighted to send droves of people rushing back into earning to give when there wouldn't be any consensus for what interventions they should earning to give to.

palcu @ 2022-11-20T12:14 (+16)

FYI that this comment appeared in the The Economist's last edition.

palcu @ 2022-11-09T10:53 (+7)

I wonder if it has something to do with interest rates. While the rates were low, the situation was "people constrained" and funding was plentiful. Now that the rates are high, capital becomes more of an issue.

Michael_2358 @ 2022-11-10T01:39 (+7)

Both low interest rates and high valuations for more speculative financial assets are a reflection of more demand for financial assets than supply. They are both functions of the overall level of savings in the economy, which is the source of demand for financial assets. Demographics, globalization, and inequality drove a 40 year boom in the aggregate level of savings that peaked during the pandemic. This era is now over, largely because of changes in demographics and globalization, but also because of a need for more physical investment in the real economy (energy, housing, etc). This physical investment will need to come from the more limited pool of aggregate savings, leaving less for financial assets. I have written several longer papers on this if you would like to discuss further.

freedomandutility @ 2022-11-09T12:29 (+5)

Yeah good point, would be interested to hear from people who understand this stuff

Lizka @ 2022-11-09T16:27 (+130)

A quick note from a moderator (me) about discussions about recent events related to FTX:

- It’s really important for us to be able to discuss all perspectives on the situation with an open mind and without censoring any perspectives.

- And also:

- Our discussion norms are still important — we won’t suspend them for this topic.

- It’s a stressful topic for many involved, so people might react more emotionally than they usually do.

- The situation seems very unclear and likely to evolve, so I expect that we’ll see conclusions made from partial information that will turn out to be false fairly soon.

- That’s ok (errors happen), but…

- We should be aware that this is the case, caveat statements appropriately, avoid deferring or updating too much, and be prepared to say “I was wrong here.”

- So I’d like to remind everyone:

- Please don’t downvote comments simply or primarily because you disagree with them (that’s what “disagree-voting” is for!). You can downvote if you think a comment is particularly low-quality, actively harmful, or seriously breaks discussion norms (if it’s the latter, consider flagging it to the moderation team).

- Please keep an open and generous mind. Most people are saying what they’re saying in the comments because they genuinely believe it and want to share their opinion — don’t assume that someone is misrepresenting anything deliberately unless you have good reason to believe it, and respond kindly and collaboratively.

The moderation team will be keeping an eye on these discussions — as we do with all discussions — and we plan to enforce the norms as usual. To be clear, however, we will not be censoring any particular perspective on the topic.

Vincent van der Holst @ 2022-11-10T10:02 (+90)

Just a note from someone who is an FTX customer.

I moved some of my crypto holding to FTX because I trusted them and Sam and wanted the profits from my crypto holdings to go to EA/FTX Future Fund. FTX have always told me my funds would be secured, I did not trade leveraged funds, so I'm the only rightful owner of that crypto and FTX has likely been using it to make money on leveraged instruments. This seems like fraud, and the optics of this for the EA community, and the already difficult optics of lontermism, seem to me like they will be very bad.

I'm priviliged, my holdings in FTX were 2% of my net worth (I enjoy following crypto) so I'll be fine, but many will not.

Jacy @ 2022-11-09T17:39 (+87)

Rather than further praising or critiquing the FTX/Alameda team, I want to flag my concern that the broader community, including myself, made a big mistake in the "too much money" discourse and subsequent push away from earning to give (ETG) and fundraising. People have discussed Open Philanthropy and FTX funding in a way that gives the impression that tens of billions are locked in for effective altruism, despite many EA nonprofits still insisting on their significant room for more funding. (There has been some pushback, and my impression that the "too much money" discourse has been more prevalent may not be representative.)

I've often heard the marginal ETG amount, at which point a normal EA employee should be ambivalent between EA employment and donating $X per year, at well above $1,000,000, and I see many working on megaproject ideas designed to absorb as much funding as possible. I think many would say that these choices make sense in a community with >$30 billion in funding, but not one with <$5 billion in funding, just as ballparks to put numbers on things. I think many of us are in fortunate positions to pivot quickly and safely, but for many, especially from underprivileged backgrounds, this collapse in funding would be a complete disenchantment. For some, it already has been. I hope we'll be more cautious, skeptical, and humble in the future.

[Edit 2022-11-10: This comment started with "I'm grateful for and impressed by all the FTX/Alameda team has done, and", which I intended as an extension of compassion in a tense situation and an acknowledgment that the people at FTX and Alameda have done great things for the less fortunate (e.g., their grants to date, choosing to earn to give in the first place), regardless of the current situation and any possible fraud or other serious misbehavior. I still think this is important, true, and often neglected in crisis, but it distracts from the point of this comment, so I've cut it from the top and noted that here. Everyone involved and affected has my deepest sympathy.]

Jason @ 2022-11-09T23:41 (+71)

Obviously this is very breaking news, but depending on the ultimate facts, I would be nervous about the risk of a clawback action if I were an organization that had received funding from an FTX-aligned source in the past few years. It's been a while since I took bankruptcy law, but the trustee can have pretty significant clawback powers when the debtor was actually insolvent at the time of transfer and the transfer was not for value. Of course, we do not know at this juncture whether the insolvency is of recent origin or existed for a while before this week.

I would also consider deferring any sizable donations to an organization I thought might be at risk for a crippling clawback, stick those monies in a DAF or similar entity for the time being, and ask the DAF to slowly regrant to the at-risk organization over time depending on the circumstances until it became clear there was no clawback risk. If a charitable organization is subject to a large clawback, it might be more efficient to move the charity's operations to a new charity (paying FMV for any assets, of course). In that case, it would be better to have not given money to the exposed charity as that money would end up in the hands of FTX's creditors. For instance, a number of charities had to pay clawbacks in the Madoff scandal despite not having committed any wrongdoing -- despite the name, there does not have to be any evil intent to have been involved in a fraudulent conveyance.

None of this is intended to be in the least bit authoritative -- it is merely a suggestion to stop and assess risk before taking certain significant actions in the short run.

N N @ 2022-11-10T01:30 (+12)

What happens if the money was donated to a charity that is subject to clawbacks, but the charity then spent the money? Do they try to claw it back from the suppliers or employees or whoever? Can it trigger a cascade of bankruptcies?

Jason @ 2022-11-10T01:57 (+29)

Employers, suppliers, etc. should be safe. Although the underlying law is complex, at a high level a clawback is possible when (as Wikipedia describes "constructive fraud") the transfer "took place for less than reasonably equivalent value at a time when the debtor was in a distressed financial condition." If I sell my labor (or widgets) to Charity X and receive a fair market wage or price in return, then the transfer took place for reasonably equivalent value and all creditors can generally pound sand.

It can get more complex, though. Let's say I am a supplier of products to a charity and let them pay me 90 days after delivery, or maybe they are late in making payments. I'm now a creditor, and if the charity is insolvent, then paying back my loan could lead to a clawback because it's seen as the charity favoring me over other creditors. That's why vendors often demand cash on delivery to supply financially distressed companies. It's possible for payments to employees to become problematic -- if you're insolvent and hand out certain bonuses, you can expect some extra scrutiny as to whether the business received reasonably equivalent value in exchange.

To underscore the complexity this stuff can reach, Irving Picard and his firm have spent something like $1 billion in legal fees and over a decade going after money for net losers in the Madoff scheme using similar theories.

aogara @ 2022-11-08T20:06 (+60)

Matt Levine seems to agree. Some quotes from his article:

Is Binance paying FTX tens of billions of dollars for its equity? I would be very, very, very surprised!

My main assumption is that if you are a crypto exchange facing a “significant liquidity crunch,” and you call up a bigger crypto exchange to ask for help, and you sign a deal for them to buy you the same day, then the price that they are paying you is, roughly speaking, zero.

There is precedent. In my world, the most famous precedent is probably JPMorgan Chase & Co. buying Bear Stearns Cos. for $2 per share one Sunday in 2008, “less than one-tenth the firm’s market price on Friday.” (Later the price was revised up.) If you need a bailout from JPMorgan over the weekend, JPMorgan will step in and make sure that your business can keep operating and that your customers will get paid and that the financial system does not collapse, but you won’t get paid much.

But in the crypto world, the famous precedents are pretty much Sam Bankman-Fried

bailing out crypto lenders this summer. FTXbailed out BlockFi Inc., getting an option to buy it foras little as $15 millionor as much as $240 million; it had been valued at $3 billion in 2021. Alameda helped out Voyager Digital with a $75 million loan, and FTX ultimately agreed tobuy its assets out of bankruptcy, cashing out customers but paying something like $51 million for its actual business; its equity market capitalization was more than $1 billion in April.This summer large crypto firms were on sale at pennies on the dollar if you had some ready cash and a tolerance for risk; Bankman-Fried did... Now, it seems, his large crypto firm was on sale at pennies on the dollar, and Zhao has the cash.

Stan van Wingerden @ 2022-11-08T20:24 (+38)

luca @ 2022-11-08T22:56 (+27)

Another Bloomberg article to add context [original; non-paywalled].

(As an outsider, setting FTX+Alameda=$2 seems crazy low? But asset breakdown here seems useful)

[SBF] looked poised to leverage his fortune — $26 billion at its peak — to shape the world, donating millions to Democrats and promising that one day he’d give it all away to political causes and charity.

Bankman-Fried’s 53% stake in FTX was worth about $6.2 billion before Tuesday’s takeover, according to the Bloomberg Billionaires Index, based on that fundraising round and the subsequent performance of publicly traded crypto companies.

FTX wasn’t Bankman-Fried’s most valuable asset, though. That was his crypto trading house, Alameda Research, which contributed $7.4 billion to his personal fortune.

The Bloomberg wealth index assumes existing FTX investors, including Bankman-Fried, will be completely wiped out by Binance’s bailout, and that the root of the exchange’s problems stemmed from Alameda. As a result, both FTX and Alameda are given a $1 value.

That leaves SBF’s net worth at about $1 billion, down from $15.6 billion heading into Tuesday. The 94% loss is the biggest one-day collapse ever among billionaires tracked by Bloomberg.

Crypto news site CoinDesk reported on Friday that a token issued by FTX, FTT, made up about a quarter of Alameda’s $14.6 billion in assets. Another item, labeled “FTT collateral,” accounted for $2.16 billion.

Sabs @ 2022-11-08T23:13 (+23)

Hypothetically, let's just say I own a business, Andromeda Research, with $500 million of assets and about 8 billion of outstanding liabilities? How much would you pay to acquire this concern? Perhaps $1 might seem quite a lot, in context?

Neel Nanda @ 2022-11-08T23:09 (+1)

I am confused by the claim that FTX's collapse => Alameda = fuck all, I thought it had about $10B in non FTT assets. But thanks for sharing!

Benjamin_Todd @ 2022-11-08T23:52 (+23)

The original rumour was that Alameda would have net negative assets if FTT coin collapsed. Though there's a chance it's actually OK.

ElliotJDavies @ 2022-11-08T20:19 (+4)

Useful context, thanks for sharing

Pablo @ 2022-11-09T21:06 (+59)

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of http://FTX.com.

Guy Raveh @ 2022-11-09T21:42 (+6)

the latest news reports regarding mishandled customer funds and alleged US agency investigations

Which and which?

Edit: Really confused by the downvotes. I haven't found updated news sources on this.

Greg_Colbourn @ 2022-11-10T10:04 (+4)

See here re US agency investigations.

Charlie Sanders @ 2022-11-09T01:08 (+57)

Is it kosher to discuss CZ's allegation that SBF was utilizing a fractional reserve scheme despite SBF's claims to the contrary, and that this undeclared leverage may have contributed to the current situation?

Nathan Young @ 2022-11-09T01:12 (+23)

Sure. Certainly I don't understand how assets can both have been covered but then they needed to be bought out by binance.

trait-feign @ 2022-11-09T09:58 (+5)

Potentially held in less liquid forms? So it could be difficult to get the money out fast enough.

Nathan Young @ 2022-11-09T10:38 (+6)

If so, why not just point to the wallets and say "the money is here but it's just gonna be slow to access"?

Lukas_Gloor @ 2022-11-09T11:48 (+14)

Yeah, it's naive when people readily believe things that could easily be verified but aren't. That's why I'm a proponent of what this Lw user calls adversarial epistemology.

Davidmanheim @ 2022-11-09T10:04 (+5)

That's a fractional reserve scheme - they said they were carrying it all in untouched accounts.

N N @ 2022-11-10T10:18 (+2)

Is there any way that could possibly be true, given the events of the last few days?

Davidmanheim @ 2022-11-10T10:58 (+5)

I assume not, no.

Ilverin @ 2022-11-09T15:34 (+3)

Wild guess they were covered at least partially by ftt token (ftx crypto token), which declined significantly in value (especially when CZ sold $500 million). How could anyone afford to pay interest on deposits while also fully covering the deposits? (Noncrypto banks have FDIC insurance) (Also as already mentioned some FTX assets were illiquid)

Jason @ 2022-11-10T14:46 (+56)

It seems clear this morning anyone who received FTX-aligned monies is on notice that those monies may be (to make up a term) morally tainted in some fashion. Without attempting to fully delineate moral taint or establish that it exists, I submit that monies generated through fraudulent business practices that caused financial harm to identifiable victims would qualify. And gambling with customer deposits that you had promised not to gamble with would qualify in my book.

In that case, there's an argument that the monies transferred out of the business (including through insiders or their foundations) should be treated as equitably belonging to the victims, as opposed to belonging to anyone who received the transfers without giving reasonable equivalent value. (Although I am using some legal metaphors, I am attempting to ask a moral rather than legal question in this comment.)

I am wondering how the community feels about the argument that -- under some factual scenarios that are looking increasingly likely -- some FTX-aligned monies should be returned to the victims under such a theory, irrespective of whether a clawback can legally happen. My initial reaction is that there are some circumstances under which that would need to happen because the monies were never properly the transferor's to grant away.

To use a more concrete analogy, suppose that my grandmother gives me a car, and I later learn that it was stolen. Do I have a moral obligation to return the car? I would submit that I have such an obligation in some circumstances and not others.

I think anyone who provided reasonably equivalent value for funds received does not need to worry about taint. Next, I suggest that the taint dissipates if a transferee spends or irrevocably commits the transferred funds in good faith and without actual or constructive knowledge of the moral taint. I am not sure whether I think there is also a requirement that the transferee would not have spent or committed the monies absent the donation.

Most fundamentally, I submit that there has to be a sufficient causal and temporal nexus between the source of the taint and the specific monies for the monies to be tainted. So it would generally be morally OK to keep donations from (say) Harvey Weinstein, because his crimes were independent of the genesis of any funds he donated. Also, if the monies were clean at the time of transfer, I would submit that the transferor's subsequent actions could not taint them. So if FTX was clean until the end, then any transfers it irrevocably committed to charity prior to the onset of any fraud would generally be untainted in my book. They might cause an optics/PR problem, but that's another story.

All that is to say, however, that there's a good chance there is significant money out there whose origin story is analogous to Grandma stealing a car and giving it to me under circumstances where I should give the car back.

Geoffrey Miller @ 2022-11-08T21:45 (+50)

Thanks to Nathan et al for this useful post. It's still pretty unclear what exactly happened, why it happened, what happens next, and what the implications are for FTX, Future Fund, and EA.

It is clear (as of c. 2:45 pm mountain time, Nov 8) that the FTX/Binance situation caused a sharp and dramatic drop in crypto asset prices today (ranging from -10 to -25% for major tokens).

For anybody heavily invested in crypto (like me), I would just encourage patience, a long-term perspective, and an epistemically humble, wait-and-see attitude (rather than blind panic-selling, or over-optimistic buying-the-dip). Investor psychology means many retail investors over-react to news, and sharp drops tend to be followed by recoveries.

Also, the confluence of crypto volatility and US election day makes this an especially uncertain, emotional, and worrisome time.

Overall, the FTX situation in the last couple of days may be one of the momentously negative developments for EA funding that we've ever seen. But, this is a complicated story, it's still unfolding, and nobody seems to quite know what's happening, so it's worth following new developments, without catastrophizing too hard.

Milli | Martin @ 2022-11-09T12:39 (+6)

My 2 cents: Holding is status quo bias. In any situation buying OR selling is better, but you never know which. What you can manage is your risk exposure.

So I'd suggest for people who have significant parts of their wealth in crypto to sell to make sure they can't get wiped out and for people who are under-invested by their assessment to buy.

An easy heuristic is to think about what proportion of you wealth you want to have in crypto and work towards that. I suggest buying / selling on a schedule or with limit orders to reduce variance.

Geoffrey Miller @ 2022-11-09T16:41 (+6)

Milli - Active buying and selling can make sense -- but capital gains taxes make the picture a lot more complicated. For US citizens, short-term capital gains (e.g. from selling crypto that you've held for less than 12 months) are taxed at a MUCH higher rate (up to 37% tax rate) than long-term capital gains (e.g. from selling crypto held for more than 12 months) (up to 20% tax rate, but it really maxxes out around 15% for most middle-class investors with cap gains less than half a million $USD a year).

Anybody who's already been actively trading crypto tokens in the last few months of this bear market might as well keep trading, e.g. selling whatever you think will drop even more. But anybody who's been holding tokens for more than 12 months, and who's already facing 80% losses (on paper) should NOT necessarily sell on another slight drop -- because it would reset the capital gains tax clock on those assets.

Epistemic status: I'm not a financial advisor, crypto expert, or tax expert; just an amateur crypto investor; I'm just pointing out that the tax situation (in the US, but also in most other countries) complicates any simple expected-value analysis of trading advice for retail investors.

jmsdao @ 2022-11-08T23:32 (+41)

Might be time to update the "funds committed" table in this blog post: https://80000hours.org/2021/07/effective-altruism-growing/#how-many-funds-are-committed-to-effective-altruism

Meta is also down a lot (ergo Dustin ergo Open Phil)

RyanCarey @ 2022-11-08T23:50 (+32)

It's way too early to know with confidence, but at a first pass GV/OpenPhil is down to $5.2B (90% of $5.8B), and FTX team down to maybe double Sam's estimated 1B? Other EA crypto donors also down to maybe sub-$1B? So the total wealth could be down by about 70%. But it's also possible there have been gains that partially offset the losses.

Benjamin_Todd @ 2022-11-08T23:59 (+39)

Something like that seems right.

Though I don't believe the Forbes figure for Dustin – it seems to assume that most of his wealth comes from his meta stake, and he's said on Twitter that he'd sold a lot of his stake (and hopefully invested in stuff that's gone up). Last spring, Open Phil also said their assets were down 40% when Meta was down 60%, which could suggest Meta was about half of the assets at that point. So I expect it's too low.

Also seems like there might be some new donors in the last year.

RyanCarey @ 2022-11-09T00:15 (+20)

Probably that loss is dampened then. Although worth noting that Dustin's Asana is also down 75% since July '21 when you wrote that post. (It was down ~55% from July '21 to Spring '22.)

Benjamin_Todd @ 2022-11-09T10:25 (+5)

Yes, maybe we should model it as 10bn meta and 10bn other stuff, now worth 2.5bn and 7bn.

RyanCarey @ 2022-11-20T14:59 (+4)

Update: Dustin says that the bloomberg estimate ($11.3B) is about right, if you add on an extra $3B of foundation assets, so community wealth would be down more like 55%, not 70%.

Greg_Colbourn @ 2022-11-10T15:11 (+35)

SBF has broke his silence on Twitter.

(continues in a 21 tweet thread)

Charles He @ 2022-11-10T15:52 (+10)

For onlookers:

Basically the tweets promote the narrative that it is a short term liquidity crisis and there is a future for FTX.

As someone who strongly supports SBF, it’s perfectly clear that FTX, and Alameda is in the beyond dire position of insolvency as reported. This tweet is performative and misleading but is the best narrative the CEO can do, this fact is also is expected and normal at the same time.

David Mathers @ 2022-11-10T17:09 (+6)

Why doesn't lying about this expose him to more legal risk? Feels like the sort of thing that ought to be illegal. Or if it does, why bother? EDIT: To be clear, I don't doubt he is lying. It's just if everyone knows it a lie, and it looks bad in court, why is this the done thing?

Jason @ 2022-11-10T17:56 (+4)

From the looking bad in court perspective, the CEO of a capsizing corporation has a tough rope to balance on. Because saying nothing, or not even giving the appearance of try to save the customers and the company, poses risks too. That is not to suggest that lying about factual matters is a good idea for any corporate executive, but in some cases a heavy dose of spin might be the least bad path from a legal-risk perspective. And the amount of permissible spin may be higher if ordinary depositors/investors are not in a position to take any actions in reliance on the spin.

David Mathers @ 2022-11-10T18:16 (+2)

So is there some technical way that 'we have enough assets at current market prices to cover all deposits' can be true, whilst not actually meaning very much?

Greg_Colbourn @ 2022-11-10T18:44 (+3)

Yes, see my comment above.

Greg_Colbourn @ 2022-11-10T18:41 (+2)

"4) FTX International currently has a total market value of assets/collateral higher than client deposits (moves with prices!)." - I think this is in line with the mainstream narrative of the assets (e.g. FTT) being almost completely illiquid - i.e. no way they can sell enough without crashing price to ~zero. So kind of misleading to say it's liquidity when it's really (most likely) insolvency in practical terms.

Charles He @ 2022-11-10T18:48 (+2)

No, not at all. This "sale" already happened.

Right now, the tokens are "illiquid" in the same sense that "Charles He token" is illiquid, "depending on price".

In theory, FTT at >$20 would support the whole endeavor. Whatever happened was life and death and happened two days ago.

Lukas_Gloor @ 2022-11-10T19:25 (+28)

Whatever happened was life and death and happened two days ago.

I'd say the thing that was life and death for them wasn't so much the price of the token (that was only a trigger) but the bank run that came after the token situation hit the news. Even if the token had stayed at the same price temporarily, no one could seriously expect their stake to be worth "number of coins times price at the time" (or 50% of that, which one source reported they had "conservatively" marked it down to) given the low liquidity / low historical sales volume of the token, the fact that they had so so much of the supply, and the logic of the token dynamics where the token does well when FTX/Alameda do well, but not when they're forced to liquidate because they're already looking like they're under water.

So basically, I think it sets up a misleading narrative if we think of this as "if only the price of the token hadn't tanked due to unforeseen events (pressure by Binance)." In reality, the token wasn't worth as much as it showed on their balance sheet, and that was obvious, so it was bad for them that the balance sheet leaked, which doesn't sound good and makes you think "why and how did they get into that situation in the first place if they're supposed to take care of customer assets safely?"

Greg_Colbourn @ 2022-11-10T19:53 (+17)

50% is crazy if true. Even 10% would be generous. Conservative would be 1%, or not counting FTT at all! It's like they didn't countenance the possibility of a bank run, even after giving their arch nemesis a ton of FTT :( (Or maybe they did, and just hoped it would all come good via enough profits or something before it blew up).

Charles He @ 2022-11-10T19:27 (+4)

Yes, as you say, the FTT token wasn't worth anything even before the crash, the FTX/Alameda money to prop it up is what was operative, and is gone now.

We haven't discussed anything that would contradict the overwhelming evidence that FTX has a gap of $4B or more.

Low information threads seem undesirable if there are people who are less informed and had very high/trust in SBF, partially due to EA associations.

Lukas_Gloor @ 2022-11-10T19:03 (+7)

They probably have on their balance sheet other illiquid low-circulation coins with inflated market cap where they were early investors or even (partly) coin developers, so it's possible that the claim was technically true at the time Sam stated it.

Of course, it's an annoying game to play when you can't assume that people communicate with an intent to convey all relevant information as clearly and comprehensively as possible, so if we have to go to these convoluted interpretations, so much has already been lost.

Charles He @ 2022-11-10T19:09 (+3)

For Alameda, other "coins" were covered in the link in my first post, it's pretty clear that they aren't worth anything, even if there was no crisis.

https://dirtybubblemedia.substack.com/p/is-alameda-research-insolvent

This is probably true of any "projects" on FTX that the entities control.

Lukas_Gloor @ 2022-11-10T19:35 (+6)

Yeah but the same is true of FTT under the assumption that FTX/Alameda rely on FTT for emergency liquidity.

I guess if someone had faith that FTX/Alameda would never sell a lot of it at once, but instead slowly sell over many years while keeping the exchange operating with profits, then FTT could be worth something for buyers. But on this model it doesn't make sense to use it as collateral, let alone in any relation to backup for customer funds.

(TBC, we're not 100% what happened, but if FTT was involved in securing customer funds, that's very dumb at best and quite possibly illegal, as discussed by Matt Levine.)

You probably know all of this – I'm just commenting because IMO it's misleading to think of FTT price dropping as "the thing that was life or death for them." (Or maybe it was in a "proximate cause" kind of way, but the real problem was the reliance on FTT in the first place.)

Charles He @ 2022-11-10T19:45 (+4)

Yes, I think we're agreed.

it's misleading to think of FTT price dropping as "the thing that was life or death for them." (Or maybe it was in a "proximate cause" kind of way, but the real problem was the reliance on FTT in the first place.)

It's more like FTT was a quasi peg, they needed to keep it up at $>20. The fight that was life and death was keeping it that high with their resources.

Greg_Colbourn @ 2022-11-10T19:01 (+7)

I interpreted it as him saying that, even with FTT 80% down (and similar for other holdings), they still have enough to cover customer balances. And I'm saying that would only be true in theory as the price could still go down a lot further (and would if they liquidated all their holdings). According to the balance sheets, they held something close to the entire marketcap of FTT as based on circulating coins even before the crash. It's unlikely they've sold even a tiny fraction of that.

Charles He @ 2022-11-10T19:11 (+2)

Are you saying you have the balance sheets for FTX? Can you link?

Unfortunately, I think what you're saying is omitting liabilities, and that makes it very uninformative.

Greg_Colbourn @ 2022-11-10T19:38 (+5)

The ones that were reported by Coindesk and others last week, for which their legitimacy wasn't disputed (although here Caroline claims there is more).

If it was just a liquidity issue, surely you'd think they would've been able to fix it by now. It's quick and easy to sell crypto tokens, even OTC.

Charles He @ 2022-11-10T19:43 (+2)

Those are Alameda balance sheets.

Greg_Colbourn @ 2022-11-10T21:14 (+15)

Fair enough. WSJ story here saying that Alameda owed FTX $10B!

Will Bradshaw @ 2022-11-11T16:46 (+32)

Since it doesn't seem to have been posted here yet: FTX has filed for bankruptcy, and SBF has resigned.

David Mathers @ 2022-11-09T21:36 (+32)

This sounds bad to me in terms of 'was this just some legal bets that didn't pay off, or actually morally/legally fraudulent': https://www.semafor.com/article/11/09/2022/ftx-legal-and-compliance-teams-quit

https://www.bloomberg.com/news/articles/2022-11-09/us-probes-ftx-empire-over-handling-of-client-funds-and-lending#xj4y7vzkg

Anyone with actual finance expertise want to say if this is likely as bad as it sounds?

Nathan Young @ 2022-11-09T22:35 (+21)

The finance people I know say it sounds as bad and maybe worse.

Charles He @ 2022-11-09T22:53 (+7)

Note that Hofmann/Semafor is sort of hostile, but as characterized, it's very bad for the prospects of a recovery.

It's more likely that people don't want to "hold the bags career wise"/work 20 hours a day to fix this for uncertain comp. It's not evidence of conduct (like embezzlement)—I'm pretty sure Hoffman would go for the throat if it was.

Nathan_Barnard @ 2022-11-10T09:51 (+31)

I think people should be very careful about promoting earning to give in light of this. It still seems true that because the capital is much more unequally distributed than income if you're trying to earn to give you should be doing by trying to increase the value of equity you hold in firms rather than working a high paying job. Wealth also seems to be distributed according to a power law which also pushes towards a strategy of being extremely ambitious if one is earning to give.

I think it would be very bad if people who otherwise could do high impact direct work switched to earning to give in investment banking, consulting or corporate law as a result of this. EA funding has not declined to the point where there is an immediate crisis where relatively small amounts of money from high paying jobs is needed to keep the EA movement going - Dustin is worth somewhere between 5 and 10 billion, founders pledge has 8.5bn committed (although substantially less than 100% of this will go to the highest impact things.)

Jack Lewars @ 2022-11-09T08:40 (+25)

This post is exceptionally useful, especially for people who don't know much about crypto (like me)

Fermi–Dirac Distribution @ 2022-11-09T21:48 (+24)

Matt Levine has a new article about this. Quoting from it:

The problem is that FTX took its customers’ money and traded it for a pile of magic beans, and now the beans are worthless and there’s a huge hole in the balance sheet

Notably, if this is true it seems to possibly be a bit at odds with some of SBF's now-deleted tweets from Monday, in which he said that “FTX has enough to cover all client holdings. We don't invest client assets (even in Treasuries).”

JP Addison @ 2022-11-10T14:21 (+20)

I think that's too simplistic a read of Levine's article. It's hard to summarize as good a writer as Matt Levine, but I will try:

- Many exchanges took customer deposits and invested them speculatively, like a bank would do. FTX did not do that.[1]

- FTX offered leveraged financial products. When doing so, you are loaning people money. Fortunately, you are loaning some people Bitcoins secured by $s and other people $s secured by Bitcoin. So you loan them each-other's money. This is entirely expected.

- The surprising thing is that FTX had a bunch of loans out in $s and Bitcoin secured by FTT. The problem with that is that "If people start to worry about the [FTX]'s financial health, [FTT] will go down, which means that its collateral will be less valuable, which means that its financial health will get worse, which means that [FTT] will go down, etc. It is a death spiral."

FTX is (was?) in the business of trading customers' money in one currency for customers' money in other currency. With the benefit of hindsight[2] we can say that they should not have allowed a large chunk of the money they ended up with to be FTT. That is the "magic beans" that Matt is referencing.

Edit: After writing the above, I read that Nathan's market "By April, will evidence come out that FTX gambled deposits rather than keeping it in reserves?" contains "This includes lending deposits to Alameda on a 'fully collateralized' loan, and Alameda doing things with the deposits." I would bet for a yes resolution on that market. However, I would note: Alameda was playing within the same structure as any other depositor. FTX allowed people to make leveraged bets on FTT, and Alameda took them up on it.

- ^

I'll bet with people at pretty good odds about this. (However, see my edit.)

- ^

Possibly with only foresight one could have said that! I don't know, I wasn't in a position to say! Matt Levine doesn't seem particularly impressed with that decision. I would not make confident claims either way at the moment.

Benjamin_Todd @ 2022-11-08T23:44 (+24)

Thank you for writing - seems like a good summary of what I've seen.

HaydnBelfield @ 2022-11-10T09:58 (+23)

This is interesting: https://www.reuters.com/technology/exclusive-behind-ftxs-fall-battling-billionaires-failed-bid-save-crypto-2022-11-10/

In particular, here's another hypothesis for why Binance withdrew:

By ditching the deal, Binance had also avoided the regulatory scrutiny that would likely have accompanied the takeover, which Zhao had flagged as a likelihood in a memo to employees that he posted on Twitter.

Financial regulators around the world have issued warnings about Binance for operating without a license or violating money laundering laws. The U.S. Justice Department is investigating Binance for possible money laundering and criminal sanctions violations. Reuters reported last month that Binance had helped Iranian firms trade $8 billion since 2018 despite U.S. sanctions, part of a series of articles this year by the news agency on the exchange's financial crime compliance.

How did Binance have such leverage over FTX?

When FTX in May 2021 applied for a license in Gibraltar for a subsidiary, it had to submit information about its major shareholders, but Binance stonewalled FTX’s requests for help, according to messages and emails between the exchanges seen by Reuters.

Between May and July, FTX lawyers and advisors wrote to Binance at least 20 times for details on Zhao’s sources of wealth, banking relationships, and ownership of Binance, the messages show.

In June 2021, however, an FTX lawyer told Binance’s chief financial officer that Binance wasn’t “engaging with us properly” and they risked “severely disrupting an important project for us.” A Binance legal officer responded to FTX to say she was trying to get a response from Zhao’s personal assistant, but the requested information was “too general” and they may not provide everything.

By July of that year, Bankman-Fried had tired of waiting. He bought back Zhao’s stake in FTX for about $2 billion, the person with direct knowledge of the deal said. Two months later, with Binance no longer involved, Gibraltar’s regulator granted FTX a license.

That sum was paid to Binance, in part, in FTX’s own coin, FTT, Zhao said last Sunday - a holding he would later order Binance to sell, precipitating the crisis at FTX.

Greg_Colbourn @ 2022-11-10T10:18 (+6)

Looks like it was a massive strategic error accepting Binance as an investor in the first place (they were the no.1 exchange, so had incentive to derail any smaller exchange; derailing is made easier by being an insider via investment!). And then a massive tactical error paying Binance back in FTT! (And this is not to mention the (likely) massive error of engaging in "fractional reserve banking" with a crypto exchange..)

Lukas_Gloor @ 2022-11-10T10:45 (+15)

They may not have had better alternatives at the time. But yeah, then rather accept slower growth or give up – except if you've got an extreme upside-focused mentality that isn't worried about negative consequences.

freedomandutility @ 2022-11-10T15:30 (+2)

I assume AI timelines also contribute to the rush

Agrippa @ 2022-11-12T09:27 (+22)

I have to say I didn't expect "all remaining assets across ftx empire 'hacked' and apps updated to have malware" as an outcome.

Sharmake @ 2022-11-12T22:47 (+2)

Or more sinisterly, he hacked it himself, and is trying to steal all of his customer's money.

Juan Gil @ 2022-11-08T20:18 (+22)

[this comment references the first version of this post, which has since been edited substantially such that this qualification no longer feels necessary]

Just want to note that my main contribution to this post was listing out questions I wanted answered to inform what EAs or the EA community should do. I have a lot of uncertainty about the structure of what assets belong to whom (compared to previous expectations) and what this implies about the EA funding landscape.

I don't have high confidence in empirical claims that might be made in this post, and I think there should be a more obvious qualifier at the beginning indicating that this was put together quickly with some crowdsourcing (and that it will be updated in response to spotted inaccuracies).

Nathan Young @ 2022-11-10T00:38 (+2)

Happy to remove your name Juan if you are uncomfortable though also I think most of the empirical claims are doing pretty well.

Juan Gil @ 2022-11-10T14:52 (+4)

I agree, most of my uncertainty / hedging was on parts of the post that were removed within a few hours of posting. Thanks for checking.

Sabs @ 2022-11-08T20:23 (+2)

Re funding, does anyone know if the FTX Foundation is an actual legal entity? If so ,I imagine its funds should be relatively safe at least in the short-term (i.e Binance/bankruptcy court will have no claim on them). Although perhaps when FTX depositors sue, they might have some claim if it can be shown (as it probably can) that the Foundation's assets were gained through some kind of illegal activity? If not, and "FTX Foundation" is just a name for SBF giving money out of the (formerly big) pot of Alameda/FTX funds, then it probably all dries up overnight.

AdamGleave @ 2022-11-09T02:48 (+23)

Disclaimer: I do not work for FTX, and am basing this answer off publicly available information, which I have not vetted in detail.

Nick Beckstead in the Future Fund launch post described several entities (FTX Foundation Inc, DAFs) that funds will be disbursed out of: https://forum.effectivealtruism.org/posts/2mx6xrDrwiEKzfgks/announcing-the-future-fund-1?commentId=qtJ7KviYxWiZPubtY I would expect these entities to be sufficiently capitalized to provide continuity of operations, although presumably it'll have a major impact on their long-run scale.

IANAL but I'd expect the funds in the foundation/DAF to be fairly secure against bankruptcy or court proceedings. Bankruptcy courts can't just claw back money arbitrarily from other creditors, and limited liability corporations provide significant protection for directors. However, I'd expect assets donated to FTX Foundation or associated DAFs to largely be held in-kind (again, this is speculation, but it's standard practice for large philanthropic foundations) not liquidated for cash. These assets mark-to-market value are likely worth a lot less than they were a week ago.

aogara @ 2022-11-08T20:31 (+7)

Why do you think there will be lawsuits? Have other crypto exchanges that went under resulted in lawsuits? Not disagreeing, just not up to date on this stuff.

Hadrian @ 2022-11-08T21:43 (+7)

There have not actually been many exchanges that went under, but there's been lawsuits re: Luna and 3AC, the two other big crypto stories this year (this one trumps both by a long shot). The only other example of a big exchange scandal I know is BitMEX , and while I don't know of any civil lawsuits the founders, one of them a major EA funder, were criminally indicted in the US.

Sabs @ 2022-11-08T21:57 (+5)

yeah the crypto lending platforms that went under, well, they lent badly. But an exchange is not supposed to be lending out customer funds at all! Ergo I think there's a lot more lawsuit potential. And ofc FTX is way bigger.

fwiw I think it's no better than a coinflip that CZ/Binance actually buys; it very much depends on just how big the hole in the FTX/Alameda balance sheet is. When Full Tilt Poker went under and it turned out they also had not segregated customer funds, Pokerstars came in to make FTP depositors whole. But Pokerstars did this because they were getting kicked out of the US, wanted to come back to the US one day when regulations changed, and wanted to buy themselves some credit with US regulators by buying FTP and assuming its liabilities. But CZ/Binance have never really acted like the sort of people who care all that much about what regulators think.

Lukas_Gloor @ 2022-11-09T14:32 (+10)

What's not even being discussed yet is ties to Tether of both Binance and FTX. Tether seem shady/criminal, but both FTX and Binance have stated they think tether 'FUD' is wrong. In a worst-case scenario where FTX is insolvent and billions in the hole, maybe one reason for Binance to step in at a loss could be that Binance wants to prevent info about tether dealings from leaking. (I'm completely speculating here!)

Hadrian @ 2022-11-08T22:27 (+1)

Yes agreed the litigation potential could be much higher here, but depends very much on details we don't know yet and what's to come. Withdrawals continued to go forward and deposits are safe, the only significant damages so far it seems is the drop in FTT, but that keeps us in typical crypto-implosion territory, my understanding is trading volume in FTT is not high.

Also, this would only matter for SBF's wealth if they were able to go after him personally at this point assuming he is 100% out of FTX, which unless things were extremely shady and bad under the hood will not happen. If they go after FTX (and sale goes through), that's Binance's problem now.

Sabs @ 2022-11-08T22:35 (+8)

Withdrawals are definitely not going through on FTX itself - only on FTX US afaik.Very much doubt deposits on FTX itself are safe in the slightest - depositors there are basically 100% reliant on the Binance deal going through.

Cullen_OKeefe @ 2022-11-08T19:40 (+21)

I'm confused why you say

This means SBF has lost control of around ~50% of his resources. It will have damaged the value of FTX US and Alameda as well.

Two things have happened:

- The value of FTX appears to have gone down (a lot).

- Some part of FTX is potentially being sold to Binance.

(1) causes Sam to lose control of a lot of his resources, because those resources have essentially evaporated with the value of FTX. But conditional on (1) happening, doesn't (2) just mean that whatever value SBF retains after (1) is converted from equity in (the relevant part of) FTX to cash? "Losing control" implies something bad has happened in addition to the loss of value of FTX. I'm not sure what else that is.

Noep @ 2022-11-08T20:17 (+6)

Nathan's post is not entirely wrong though. If FTX.com sells at a discount, we have no idea who gets paid first. Maybe it takes FTX to sell and lose 50% of its value for SBF to get zero, maybe it takes 90% discount, maybe 99%?

This happens a lot when there are aqui-hires because of start-up going bankrupt, and employees with shares get 0 because investors have prefered payback clauses

Cullen_OKeefe @ 2022-11-08T20:28 (+7)

I agree we have no idea what the terms of the deal are, which is why I don't think we can say what the total effects on SBF's assets are other than by informed guessing.

Noep @ 2022-11-08T20:36 (+1)

Not only we have no idea of the terms of the deal for FTX.com, but it seems hard to predict what it means for the value of FTX US (what does the probability of another bank run look like now?) and Almeda (did they actually use FTX.com's info/cash as a significant generator of alpha?)

Charles He @ 2022-11-08T20:24 (+6)

It's almost certain that the residual value after FTX.com's sale will be very low.

There are also major implications for Alameda trading and the remaining FTX entities.

Nathan Young @ 2022-11-10T00:37 (+3)

It's easy for me to say this now, but the reason I said it was because I sensed that that chunk would be valueless and maybe much of the rest. ~50% was my median value between 20% and like 90%.

But it felt a little exhausting to say that given I couldn't really justify it.

It's cheeky of me to say this without evidence, (though I guess maybe we could find me rewording it in the original google doc)

Milan_Griffes @ 2022-11-10T19:23 (+19)

https://twitter.com/AutismCapital/status/1590779299946442753

tl;dr – insider source says many FTX employees etc have lost their life savings; SBF had a history of pitching them to double-down on holding FTT and other assets on the exchange

Milan_Griffes @ 2022-11-10T23:47 (+13)

Follow-up from an independent source: https://twitter.com/AutismCapital/status/1590852094894149632

Michael_2358 @ 2022-11-08T23:00 (+19)

Bloomberg is estimating the recent events have caused SBF’s net worth to decline 94% from $15.6B to $1B. I think they are suggesting Alameda and FTX have zero value. I hope that is not accurate. In combination with the 75% decline in Meta it would mean a lot less funding for EA causes until new mega donors are recruited.

Fermi–Dirac Distribution @ 2022-11-08T22:55 (+19)

Bloomberg now estimates that FTX and Alameda are both essentially worth $0, and that SBF is no longer a billionaire.

His remaining estimated wealth ($991 million) seems to mostly be based on his stake on FTX.us, which AFAICT has not been affected by today's events. [ETA: also Robinhood stock.]

Fermi–Dirac Distribution @ 2022-11-10T23:15 (+14)

Today, Bloomberg updated its estimate of SBF's personal wealth:

As for Bankman-Fried’s personal net worth: Following FTX.US’s announcement about a potential trading halt, its value was reduced to $1 by the Bloomberg Billionaires Index. Bankman-Fried owns about 70% of the business, according to the index. It had been valued at $8 billion in a January fundraising round.

A 7.6% stake in Robinhood Markets Inc. was also removed from his wealth calculation, after Reuters reported that it was owned through Alameda and may have been used as collateral for loans.

As a result, Bankman-Fried now has no material assets tracked by the Bloomberg wealth index. At the start of this week, his fortune was $15.6 billion.

jacquesthibs @ 2022-11-10T08:45 (+17)

The following tweet is being shared now: https://twitter.com/autismcapital/status/1590551673721991168?s=46&t=q60fxwumlq0Mq8CpGV3bxQ

This is obviously just a random unverified source, but I think it will be worth reflecting on this deeply once this is all said and done. It feeds directly into how EA’s maximizing behaviour can lead to these outcomes. Whether the above is true or not, it will certainly be painted as such by those who have been critical of EA.

Kate Tran @ 2022-11-09T07:47 (+17)

Thank you for sharing your thoughts on this. It's such an uncertain time and I want to express my sympathy to you and the FTX's team.

With all the above discussion, make me wonder the following things:

- how other EA orgs that were mainly funded by FTX will operate and what are ways to help those that affected severely in this situation?

- how the hiring opportunities may be affected? is there expected a hiring freeze from most EA-orgs?

- what are the next best strategies when it comes to funding diversity and the future of EA overall