Manifund x AI Worldviews

By Austin, Rachel Weinberg @ 2023-03-31T15:32 (+32)

This is a linkpost to https://manifund.org/rounds/ai-worldviews?tab=about

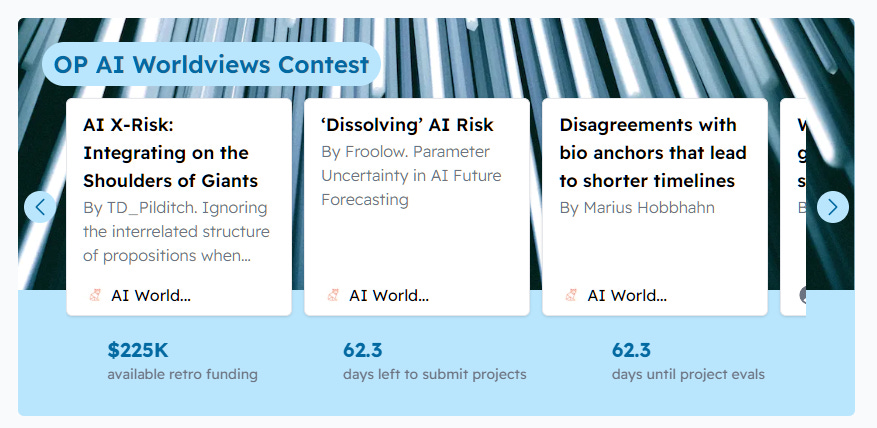

Manifund is hosting impact certificates for the Open Philanthropy AI Worldviews Contest!

- Open Phil is running this essay contest on AI safety, with $225k in prizes

- Essay authors can now sell shares of potential winnings on Manifund

- Accredited investors can invest to support authors and predict the results

Check out existing entries here: https://manifund.org/rounds/ai-worldviews

FAQ

What are impact certificates?

They’re like equity, but for charitable projects. Here’s an example for this contest round:

- Alice submits an essay called “AGI by 2043? More Like AG-Why Not?” (credit to ChatGPT for the title).

- On Manifund, she offers to sell 20% of stake in her future winnings at a total valuation of $5,000

- Bob takes her up on this offer, purchasing 20% equity for $1,000.

- Ultimately, Alice wins $25,000 for third prize.

- Because Bob owns 20% equity, she pays him 20% of her winnings ($5,000), and keeps the other $20,000.

You can read more about impact certificates on Manifund’s about page.

What’s in it for essay authors?

Mostly hedging. Past EA contests have been critiqued for having too steep a drop off in prize money and thus under-compensating valuable but non-winning contributions, some of which required a lot of effort to create. This leaves the authors of such contributions uncompensated and dissatisfied, and can discourage entry in the first place.

Impact certificates curb this issue: by selling some stake in your project, you can still keep the majority of your prize if you do win, while guaranteeing that even if you don’t win, you were paid for your time writing the essay.

To start with, the Manifund team is offering to buy 5% of every good-faith submission for $50!

What percent of my impact cert should I sell?

That’s ultimately up to you, but we recommend starting by selling 10-20%.

How should I decide at what valuation to sell my impact cert?

You should choose an initial valuation equal to or a bit below your expected payout. For example, if you think there’s a 5% chance you get first prize, 5% chance you get second prize, 5% chance you get third prize, and 85% chance you get nothing, your initial valuation should be around $5,000 and no higher than $5,625.

What if I haven’t written my essay yet?

You’re still welcome to create a project on Manifund and explain in the description what you’re considering writing about and some background information about yourself. This way, if investors think you and your idea are promising, they can offer to buy equity, and you can decide whether or not to write the essay based on whether those buy offers pay for your time.

We ask that you only accept buy offers (or make sell offers) once you’re confident that you’ll actually submit an entry to the contest.

About this collaboration

Manifund is not formally collaborating with Open Philanthropy on this. However, Open Philanthropy has confirmed that authors are allowed to post their essays on Manifund and sell a share of their future earnings. Posting an essay on Manifund does not enter you into the contest — you’ll also need to submit your essay through OpenPhil’s submission form.

To kick off this round, the Manifund team has selected some high-quality essay submissions to crosspost on our platform. The impact certificates for some of these essays have not been claimed by the authors yet; still, accredited investors place buy offers for these certs, which authors can choose to accept once they’ve signed in to claim their cert.

(You may notice that some entries reference the FTX Future Fund. That’s because this contest was originally theirs, and Open Philanthropy set up a similar contest after the Future Fund shut down in October, 2022.)

Please reach out to AIWorldviewsContest@openphilanthropy.org with any questions, comments, or concerns about the contest itself. Join us on Discord for questions about Manifund or impact certs~

Jason @ 2023-03-31T15:56 (+6)

You may want to note that the requirements for being an accredited investor are pretty significant:

https://www.sec.gov/education/capitalraising/building-blocks/accredited-investor

I wonder if it would be worthwhile/legal to add a different mechanism for the significant majority of people who don't qualify as accredited investors. I could "purchase" equity in exchange for the author's commitment to counterfactually give the appropriate portion of any winnings to a stated charity of my choice.

Manifund (or someone else) might be able to buy the impact certificates on my behalf and act as my agent. Other mechanisms are possible but would require more trust.

Rachel Weinberg @ 2023-03-31T16:55 (+11)

stay tuned 🙃....

We've implemented something to allow everyone to participate now! Non-accredited investors can still put money into Manifund, grow their portfolio by investing in impact certs, and ultimately donate any money in their account to charity. They just can't withdraw. It works a lot like mana on Manifold, except that when you add money it counts as a tax-deductible donation.