Some data on the stock of EA™ funding

By NunoSempere @ 2022-11-20T12:45 (+62)

Overall Open Philanthropy funding

Open Philanthropy’s allocation of funding through time looks as follows:

Dustin Moskovitz’s wealth looks, per Bloomberg, like this:

If we plot the two together, we don’t see that much of a correlation:

Holden Karnofsky, head of Open Philanthropy, writes that the Blomberg estimates might not be all that accurate:

Our available capital has fallen over the last year for these reasons. That said, as of now, public reports of Dustin Moskovitz and Cari Tuna’s net worth give a substantially understated picture of our available resources. That’s because, among other issues, they don’t include resources that are already in foundations. (I also note that META stock is not as large a part of their portfolio as some seem to assume)

Edited to add: Moskovitz replies:

Actually the Bloomberg tracker looks pretty close, though missing 3B or so of foundation assets. The Forbes one is like half the Bloomberg estimate 🤷♂️

— Dustin Moskovitz (@moskov) November 20, 2022

In mid 2022, Forbes put Sam Bankman-Fried’s wealth at $24B. So in some sense, the amount of money allocated to or according to Effective Altruism™ peaked somewhere close to $50B.

Funding flow restricted to longtermism & global catatrophic risks (GCRs)

The analysis becomes a bit more interesting if we look only at longtermism and GCRs:

In contrast, per Forbes, the FTX Foundation had given out $160M by September 2022. My sense is that most (say, maybe 50% to 80%) of those grants went to “longtermist” cause areas, broadly defined. In addition, SBF and other FTX employees led a $580M funding round for Anthropic

Further analysis

It’s unclear what would have to happen for Open Philanthropy to pick up the slack here. In practical terms, I’m not sure whether their team has enough evaluation capacity for an additional $100M/year, or whether they will choose to expand that.

Two somewhat informative posts from Open Philanthropy on this are here and here

I’d be curious about both interpretative analysis and forecasting on these numbers. I am up for supporting the later by e.g., committing to rerunning this analysis in a year.

Appendix: Code

The code to produce these plots can be found here; lines 42 to 48 make the division into categories fairly apparent. To execute this code you will need a working R installation and a document named grants.csv, which can be downloaded from Open Philanthropy’s website.

Patrick Gruban @ 2022-11-20T21:54 (+13)

Dustin Moskovitz commented on Twitter:

Actually the Bloomberg tracker looks pretty close, though missing 3B or so of foundation assets. The Forbes one is like half the Bloomberg estimate [shrug emoji]

Guy Raveh @ 2022-11-20T15:57 (+6)

Thanks for this!

There's more discussion here than ever, following the FTX scandal, and most of it is really vague. For the useful parts of it - how to prepare for such shocks and how to deal with them afterwards - I hope data and visualisations like this can make them more productive.

david_reinstein @ 2022-11-20T23:08 (+4)

Data comments:

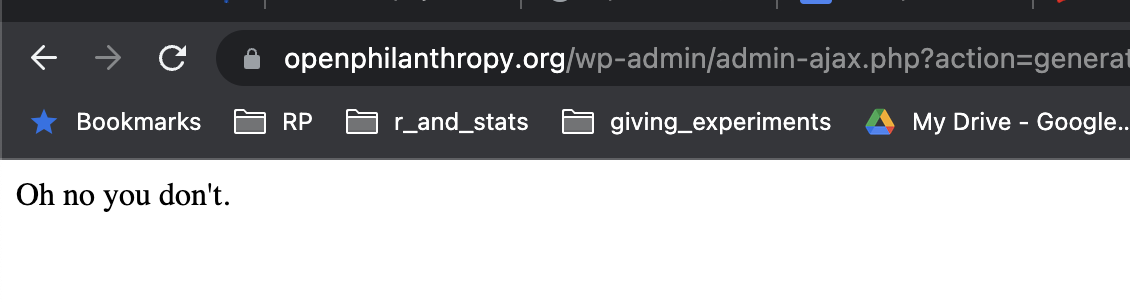

For some reason Open Phil's site is not allowing the spreadsheet download:

Aaron Gertler @ 2022-11-21T07:24 (+5)

Thanks for pointing this out — as an FYI, you can DM me about any problems with the OP website. I'll look into the bug (and make sure we improve the error message, yikes).

Update: Now fixed!

Making this account feels almost as bad as pulling a "Holden", @ 2022-11-20T23:40 (+4)

That "error"—I just spat out my coffee lol.

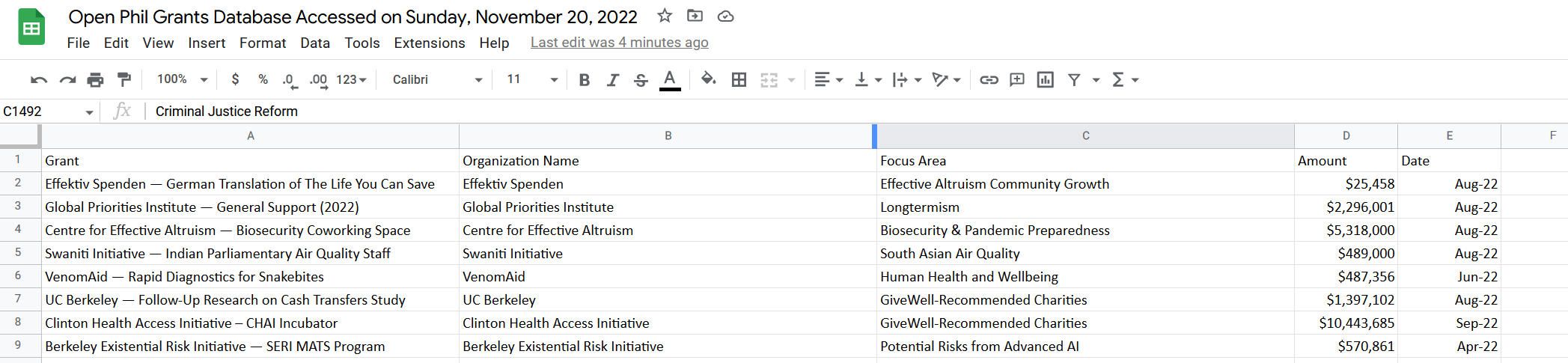

I probably got around it. Here's what might be the Open Phil database of grants/investments, accessed today.

https://docs.google.com/spreadsheets/d/1F7-WOHbr5bEfV-rohIoBv4wv_4CSP9AOKCYbYd4s4Ds/edit?usp=sharing

(It has 1500 entries)

Mr. Gertler?

NunoSempere @ 2022-11-21T10:48 (+3)

That "error"—I just spat out my coffee lol.

Lol, I briefly thought this was about my post when seeing this in the notifications and I "jumped" a bit.

NunoSempere @ 2022-11-21T10:47 (+2)

I also provided a link above: <https://nunosempere.com/blog/2022/11/20/brief-update-ea-funding/.source/grants.csv> (though it won't be up to date).

Edit: Whoops, I see that the document cuts halfway through and don't have plans to fix it, so I'm retracting this comment.

Abby Hoskin @ 2022-11-20T22:48 (+4)

These are really interesting figures, thanks so much for sharing!

Is the 2022 data up to date through November? Or does it cut off substantially earlier in the year? Wondering why it's so much lower than 2021.

Sorry I'm being lazy here and not looking at the raw data myself.

NunoSempere @ 2022-11-21T10:50 (+2)

Hey, data is up to whatever was added to Open Philanthropy's database as of a few days ago. I imagine this does include most grants in November, but not sure.

Alex_Altair @ 2022-12-28T22:12 (+3)

If we plot the two together, we don’t see that much of a correlation

...That looks like a fairly strong correlation to me? Maybe I'm reading this graph wrong, but only the data point for 2018 looks substantially different.

Vasco Grilo @ 2022-11-20T17:54 (+2)

Thanks for raising awareness about this!

I wonder how much resources are invested into assessing opportunities to increase the risk-adjusted wealth of Dustin Moskovitz. Intuitively, its trajectory does not seem that much overdetermined, given its high variation. So investing something like 0.01 % to 1 % of the wealth into assessing opportunities appears reasonable to me, but I do not know. For a wealth of 10 G$, these fractions would amount to 1 M$ to 100 M$, so maybe such assessment might kind of be a cause area itself.

Guy Raveh @ 2022-11-20T18:01 (+5)

I mean, would make more sense to do for GV than for Moskovitz personally.

Vasco Grilo @ 2022-11-20T22:34 (+1)

Sure! Maybe the wealth of Good Ventures correlates well with that of Moskovitz. More generally, I was just curious to know how much is invested in assessing opportunities for growth or decrease risk relative to what would on reflection be optimal.