Investing to Give: FP Research Report

By Sjir Hoeijmakers🔸 @ 2020-10-30T12:43 (+94)

See below for the executive summary. The full report can be found here.

For context, see also our previous forum posts on our plans to set up a Long-Term Investment Fund and the early stages of this research project.

Investing to give

In 1784, the French mathematician Charles-Joseph Mathon de la Cour wrote a parody of Benjamin Franklin’s then-famous Poor Richard’s Almanack. In it, Mathon de la Cour joked that Franklin would be in favour of investing money to grow for hundreds of years and then be spent on utopian projects. Franklin, amused, thanked Mathon de la Cour for the suggestion, and left £1,000 each to the cities of Philadelphia and Boston in his will. This money was to be invested and only to be spent a full 200 years after his death. As time went by, the money grew, and in 1990 Boston received an impressive $5 million and Philadelphia $2.3 million, which was spent on charitable causes on behalf of Ben Franklin.[1]

Benjamin Franklin is one of the first people we know of who practised investing to give: purposely investing funds at one point in time in order to have more impact later. This report investigates how promising this strategy is today, and whether we could do even better than Franklin did. In particular, we are trying to answer whether, if we want to maximise our impact as philanthropists, we should do one of two things: either give to the highest-impact opportunities available now, or invest in order to give even more impactfully at a later date.

At Founders Pledge, we are considering launching a Long-Term Investment Fund for our members who would like to invest to give for maximum long-term impact.[2] This Fund would take contributions from members, invest them, and disburse the resulting funds to nonprofits at those times when the long-term impact of doing so appears highest, whether this is in five years or in 500 years. This research project on investing to give is key to our ongoing decision process on whether we should create such a Fund. Therefore, this project’s primary purpose was to evaluate investing to give from a long-term impact perspective, but we have also looked into its potential from the perspective of benefitting the current generation, and from the perspective of averting animal suffering in the near term.

In this summary, we highlight the key findings of our research project and their practical significance. For a more detailed and exhaustive explanation of our approach, our model, and the evidence and reasoning supporting our findings, we refer the reader to our full report.

1. Mary and our proxy model

We start by answering a proxy question, featuring the fictional Founders Pledge member Mary. Mary cares deeply about others regardless of where or when they live. She has $1 million that she wants to spend on making the world a better place in a way that has the highest expected long-term impact: she is open to opportunities that have a high chance of failing but would yield an outsized reward if successful. So, how can Mary best achieve this impact? Should she allocate her $1 million to a Fund which invests her money and then gives to the highest-impact funding opportunity Founders Pledge is able to find?

Importantly, for this proxy question, we choose to disregard what we call investment-like giving opportunities. We also fix the timeline of investing to give at 10 years, and assume equity market index funds as our investment strategy. The implications of releasing these restrictions are discussed later.

In order to answer the question, we estimate Mary’s expected impact of investing to give relative to her expected impact of giving today. We identify three key factors:

- The financial returns we are able to achieve in 10 years: the financial returns factor

- To what extent we are able to ensure that the funds will be spent on high-impact funding opportunities in 10 years: the persistence factor

- The difference in cost-effectiveness between the highest-impact opportunities we are able to find and fund now and in 10 years: the difference in cost-effectiveness factor

In our simple quantitative model, we make estimates for each of these factors and multiply them together to reach a ratio for the expected impact of investing to give 10 years later compared to giving now. Intuitively, this can be seen as starting with an impact of ‘1’ for giving now, and then multiplying this number by all the factors that can grow or shrink it over 10 years of investing:

impact of investing to give in 10 years = impact of giving today * financial returns factor * persistence factor * difference in cost-effectiveness factor

Our estimates for the factors are mostly based on extrapolations of historical data and expert surveys. They come with many limitations and caveats, which are discussed in detail in the report. The precise model results should hence be taken with a pinch of salt, but the overall takeaways are useful.

1.1. Model results

So, how impactful is Mary’s investment likely to be? Figure 1 shows our probabilistic estimates of the impact ratio of investing to give in 10 years compared to giving now. The figure illustrates the uncertainty in our predictions: our 90% credible interval[3] runs all the way from 0.1 to close to 40.

Figure 1. Investing to give in 10 years compared to giving today

Source: Guesstimate model

Source: Guesstimate model

We estimate that Mary will have more impact by investing than by giving today with 70% probability. More importantly, we estimate that the expected value of the impact ratio[4] is very high: Mary will have nine times as much impact by investing on average.

The high expected value illustrates a noteworthy asymmetry: Mary has more to gain by investing to give than she has to lose. In the worst cases, her invested $1 million will have no or negligible impact after it is spent 10 years from now. In the best cases, however, her invested $1 million could end up having an impact many times larger than it would now. These potentially very large gains are much more significant than the potential losses, and drive up the expected impact of investing to give.

1.2. Financial returns

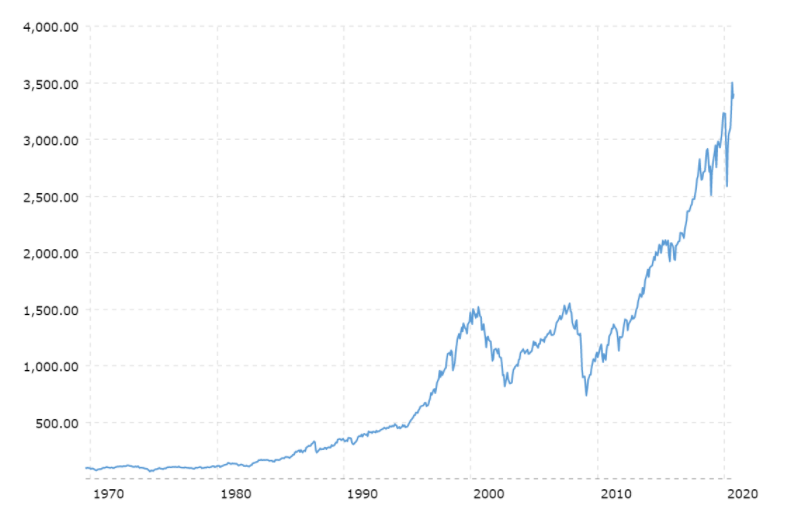

Can we make significant returns on the money we invest? We find that, through equity market index investing, it has historically been possible to quite reliably make positive financial returns on investments, as illustrated by the S&P index values that are charted in figure 2. There is certainly variance, but in the typical scenario one could double one’s financial resources - in nominal terms - over the course of a decade. This is why financial returns are the key factor driving our estimate that in the majority of cases (70%), investing to give in 10 years will have a higher impact than giving now.

Figure 2. S&P 500 Index in the past 50 years (nominal)

Source: macrotrends.net

Source: macrotrends.net

1.3. Persistence

We find that our second factor, persistence of funds and values, has the least overall influence on our estimates. There are meaningful risks of value drift and loss of ownership, but these can mostly be mitigated by a well-designed Fund. Such a Fund could, for instance, avoid risks of value drift by being legally compelled to disburse funds to the charitable sector, and avoid risks of loss of ownership by being legally decoupled from Founders Pledge.

1.4. Difference in cost-effectiveness

When deciding where to give, you want to ensure that for every dollar you donate, you’re creating the maximum possible impact: you want your donation to be cost-effective. We find the difference in cost-effectiveness of giving later to be the most important argument for investing to give overall, but also the most uncertain one. This is largely due to exogenous learning: learning that occurs over time regardless of Mary’s giving, and which will allow Founders Pledge to identify higher-impact funding opportunities. Because the field of long-term impact research is so new, there is likely still a lot to learn, even in a matter of years.

According to most of the experts we surveyed, exogenous learning over the next 10 years is the strongest factor driving up the expected cost-effectiveness of the funding opportunities that we would give to in 10 years. They predict it will outweigh other factors that could drive down cost-effectiveness - such as a larger community of impact-focused funders - with high probability. And many think there is a meaningful probability that these learnings could lead to a more-than-tenfold increase in cost-effectiveness. Hence, whilst not driving the outcome in the majority of cases, the difference in cost-effectiveness factor is the main driver for our high expected impact ratio.

However, our surveyed experts were not unanimous in this view, there were important limitations to our survey methodology and sample, and we think there is also a somewhat plausible case for a decrease in the cost-effectiveness of the best available funding opportunities over time - in particular due to more impact-focused funding outweighing the effects of exogenous learning.

1.5. Near-term aims

We also evaluated our proxy question from the perspective of benefitting the current generation and averting animal suffering. For this, we used input from impact-focused funding opportunity evaluators GiveWell, Farmed Animal Funders and Animal Charity Evaluators.

For benefitting the current generation, we estimate an expected 10-year impact ratio for investing to give compared to giving today of 2.1, and for investing to be higher-impact than giving now in 50% of cases. The difference with the long-term impact case is probably best explained by a lower projected exogenous learning rate: research into funding opportunities in this space is easier to do well, has already received a lot more time and resources, and is supported by a wealth of intervention research from development economics, which has been around even longer.

For averting animal suffering, we estimate an average impact ratio of 4.2, and for it to be higher-impact to invest to give in 10 years in 60% of cases. However, we expect there to be a large amount of investment-like giving opportunities available in this space, which strengthens the case for giving now.

2. Further considerations

2.1. Investment-like giving opportunities

Our proxy question intentionally excluded investment-like giving opportunities: giving opportunities whose primary route to impact is making more financial or human resources available to be “spent” on the highest-impact opportunities at a later point in time. A straightforward example is encouraging people with similar values to invest to give rather than not give at all.

We think these types of opportunities could in principle have similar or higher compound returns than investment, even in the longer term, mainly because they can benefit from exogenous learning as much as investing to give does.

2.2. Option value

The other significant limitation of our proxy question - and of Ben Franklin’s approach - is that it assumes disbursements of funds after a fixed amount of years. Usually, when choosing to invest to give, we don’t need to commit to any particular timeline of disbursement: the only option we lose is to give now. However, if we choose to give now, we lose all other options. Investing hence has more option value than giving now does. This has three implications.

It is, first of all, relevant for interpreting the 10-year impact ratio estimate in our proxy model: if the estimated ratio is higher than 1 - as it is - this suggests that investing is the highest-impact strategy available at this point in time, excluding investment-like giving opportunities. However, if the ratio were lower than 1, this would not immediately imply that investing is not the highest-impact strategy, as there could be other years for which the ratio would be higher than 1.

Secondly, investing to give allows us to use the “watch then pounce” strategy.[5] Even if our ability to have an impact were to decrease over time on average, it might be that, every once in a while, unusually high-impact funding opportunities arise. When investing, we have the option to fund such opportunities, whereas giving now restricts us to the funding opportunities available right now.

Thirdly, investing to give allows us to learn more about the question of when to give itself, before fixing the timing of disbursement of our funds.

2.3. Higher-return investment strategies

For our proxy question, we have assumed equity market index funds as our investment strategy. There are alternatives that might yield higher expected returns, such as leveraged index investing or venture capital investing. However, due to restrictions on higher-investment-risk investments by nonprofits in many countries, it might be difficult to set up a charitable investment fund that pursues these strategies for a large part of its investments.

We will consider both these alternatives for future research and in our plans for future investment strategies of a potential Long-Term Investment Fund.

2.4. Others’ time preference

Do most people care more about the present or the future? There is a wholly separate, theoretical argument for investing to give, rooted in the hypothesis that many people have an intrinsic preference to receive benefits now over receiving them in the future. To what extent this is true is a matter of substantial academic debate,[6] but most economists seem to agree that there is very likely some positive rate at which most people intrinsically discount future benefits.[7]

Other people’s focus on the present makes it more plausible that investing to give is a high-impact strategy in two distinct ways. First, it helps explain why we can obtain large returns on financial investments: if most people value the future less than us, they will be willing to trade their influence over the future for more influence over the present. And they will leave to us some of the investment opportunities that are advantageous from the perspective of benefitting the long term. Second, it makes it more likely that humanity as a whole is overspending in the present, and that by offsetting this, we can improve humanity’s overall spending portfolio by investing.

2.5. Considerations found to be less important

In the report, we address many other considerations which have some weight in our overall view of investing to give. These include general considerations on compound returns on giving now, investment and fund management costs, the impact of investing itself, and correlations among our key factors. We found none of these to be strong enough in either direction to affect the overall balance, though they do increase our overall uncertainty.

3. Conclusions and recommendations

3.1. Benefitting the long term

Based on the analysis in this report, we think investing to give is a very promising strategy for any long-term-oriented individual philanthropist to consider at this point in time. This is primarily because of current opportunities for exogenous learning and financial returns, and because of the option value investing to give carries. However, giving to investment-like giving opportunities could be a good alternative to investing to give.

Given the many limitations in our analysis, we do not think we can confidently claim investing to give is a higher-impact strategy than giving today. Still, we believe it is plausible that it could be, and we recommend our members to at least consider making it a part of their philanthropic portfolio.

For Founders Pledge in particular, the conclusions of this research project are a strong argument to set up a Long-Term Investment Fund for our members. We have started exploring the practicalities of doing this, and tentatively expect to launch such a Fund in 2021.

3.2. Benefitting the near term

We think investing to give is an option worth considering for members focused on benefitting the current generation, but only when a suitably designed investment and granting vehicle becomes available. We think it is less promising than for members focused on benefitting the long term, mainly because there seem to be fewer opportunities for exogenous learning.

Similarly, we think investing to give is an option worth considering for members focused on averting animal suffering in the near term. However, we wouldn’t be surprised if there are investment-like giving opportunities in this space that can outperform or at least match investing to give. We are generally less confident in our conclusions here than in the case of benefitting the long term or the current generation of people.

3.3. When should we stop investing and start giving?

If investing to give is indeed a higher-impact strategy than giving now - at least from a long-term impact perspective - then when is this no longer the case? When should we stop investing and start giving? Our model and analysis show multiple ways in which this could occur. For instance, we could see the exogenous learning rate diminish - and not expect it to go up again - as to some extent seems to have already happened in the case of benefitting the current generation. Or expected investment returns could go down substantially. Also, there could be times with extraordinary funding opportunities during which we should give at least part of our funds (the “watch then pounce” strategy).

Lastly, our recommendations here target the individual philanthropist and become less valid at very large (>$100 million) philanthropic budgets. At that point, whether you immediately give or invest to give starts to meaningfully influence the distribution of high-impact giving and investing at a global level, and new considerations come into play, such as diminishing marginal returns to giving in a particular year. Furthermore, the “watch then pounce” strategy arguably has diminishing marginal returns: most of its value can be achieved by a Long-Term Investment Fund with a limited amount of funds.

Michael D. Klausner, ‘When Time Isn’t Money: Foundation Payouts and the Time Value of Money’, SSRN Electronic Journal, 2003, https://doi.org/10.2139/ssrn.445982. ↩︎

See this article by career advice organisation 80,000 Hours for a good introduction to general considerations when trying to benefit the long term. We aim to publish more on this ourselves soon. ↩︎

Credible intervals are the Bayesian equivalent of confidence intervals. See this page for more on them. ↩︎

This is the sum of all the values the impact ratio could take, weighted by their estimated probabilities. ↩︎

William MacAskill, ‘When Should an Effective Altruist Donate?’ (Global Priorities Institute, 24 September 2019), 10, https://globalprioritiesinstitute.org/william-macaskill-when-should-an-effective-altruist-donate/. ↩︎

Shane Frederick, George Loewenstein, and Ted O’Donoghue, ‘Time Discounting and Time Preference: A Critical Review’, Journal of Economic Literature 40, no. 2 (2002): 351–401. ↩︎

Moritz A. Drupp et al., ‘Discounting Disentangled’, American Economic Journal: Economic Policy 10, no. 4 (November 2018): 109–34, https://doi.org/10.1257/pol.20160240. ↩︎

jackmalde @ 2020-10-31T11:39 (+20)

Just want to say I find this topic really exciting and think your report is a great contribution to the discussion.

I hope Founders Pledge takes the plunge and creates a long-term investment fund. I’m sure the experience of doing so will be valuable and I think there will be significant informational value of having such a fund exist. I’m excited to donate to it!

bshumway @ 2020-10-31T01:01 (+15)

I find it interesting that "giving opportunities whose primary route to impact is making more financial or human resources available to be “spent” on the highest-impact opportunities at a later point in time," were intentionally excluded. One might argue that from a longtermist perspective that the primary route to impact of most EA interventions (including those typically viewed as short-termist) will manifest most of their impact via flow through effects. The compounding effects of investing in the untapped human potential of the global poor now is much more difficult to quantify that the returns on a typical investment portfolio but perhaps that is why it is so neglected.

Also, curious what Franklin's money was used for 200 years later and whether it was something that would've had more impact than if that money had been spent on high impact causes of his time.

SjirH @ 2020-11-02T14:59 (+11)

Thanks for your comment. Please note though that most types of "flow-through effects" (including those in your example, if I understand you correctly) are included in the analysis.

Investment-like giving opportunities (as defined in the report) are only a very small subset of interventions with substantial flow-through effects, namely those whose gains are reprioritised towards the highest-impact opportunities at a later point in time. Giving to them is similar to investing to give in that both can benefit from exogenous learning.

bshumway @ 2020-11-25T21:30 (+1)

I dont think that all flow through effects are (or even can be) quantified by this sort of analysis. It is surely much easier to measure the growth from an investment account than to quantify the impact of a human life or the downstream effects of improving a human life. As far as I am aware, efforts to quantify this sort of effect are not yet available to the level that I would feel very confident about a side by side comparison. If you are aware of something you believe allows for such comparison, I would be very interested in reading that.

MichaelA @ 2020-10-30T13:47 (+11)

Thanks for this report! I think that this is a very important research topic, and that this report makes quite valuable contributions to it.

I'm looking forward to seeing further developments in relation to the proposed Long-Term Investment Fund. I also hope this report will help inspire, help guide, and/or be followed up by further research in this area. In particular, I'd be keen to see more analysis regarding how strong the argument for giving now for the sake of"compound returns on giving" and/or "investment-like funding opportunities" is, as the possibility that that argument is strong is the main reason I remain unsure whether we should invest to give. (I think I lean towards investing to give on the margin, but I see those benefits from giving now as the main reason I might be wrong about that.)

[I provided comments on a draft of this report, and already said to Sjir roughly what's in this comment.]

MaxRa @ 2020-10-31T22:34 (+2)

Investment-like giving opportunities also seem most relevant to me and I'd love seeing more thought on this topic. My current intuition leans towards giving now, though my understanding feels pretty simplistic, mostly based on impressions that

- many very smart people are currently directing their intellectual and altruistic ambitions suboptimally because they never thought about prioritisation and longtermism

- there is not too much competition in offering them positions in an intellectual and altruistic environment where they can work on priority issues

I likely got this wrong, but as a concrete plausibly not actually true example, I'm thinking about a researcher like David Roodman, independently doing excellent work that caught the attention of GiveWell, influencing him to down the road directing his attention on longtermist issues. I expect there are many more people like him at different stages of their career and I'd love to see more Open Philanthropy Projects and Future of Humanity Institutes and MIRIs (maybe Edward Kmett as a similar example) and so forth where they can work or with whom they'd want to collaborate.

agdfoster @ 2020-11-13T15:39 (+6)

If someone felt we might have insights in the future that would be so valuable it makes sense to hold onto a 3-5% yearly return over inflation, why not tell them to instead fund achieving those insights, make them happen sooner?

SjirH @ 2020-11-19T16:48 (+5)

Good question! There certainly is a strong case for funding global priorities research now, but there are multiple reasons why investing to give could still be better:

- Certain insights make other insights easier to have: there might be a certain order in which insights need to be had, or at least a certain order might make things easier, and this could take time.

- Funding to achieve these insights might be done by someone else in the counterfactual, and this other person or institution might not otherwise give to (as) high-impact stuff. Note that I'm not just talking about "targeted" global priorities research here: new insights might also come from or be aided by work by non-EA institutions.

- Money isn't directly fungible with research results/it takes time to build the field of global priorities research: just throwing more money at e.g. the Global Priorities Institute will hit strong diminishing returns, and it takes time for enough talented researchers to be trained so that the field can absorb more funding.

MichaelA @ 2021-03-31T04:22 (+2)

One of the things I most appreciate about Founders Pledge's work on this topic is that it gave me the concepts and terms of endogenous vs exogenous learning. However, when I used these concepts in conversation recently, I realised that they might be framed more narrowly than would be ideal.

The way those concepts are framed in this report seems to implicitly focus solely on changes in the frontiers of humanity's understanding of a topic. (For readers who haven't read the report, I'll quote the relevant part in my reply to this comment.)

But I think it's important to also think explicitly about:

- Changes in how "close" to that frontier a specific actor's knowledge on some topic is.

- Changes in knowledge that is very specific to that actor

- E.g., knowledge about how good that actor is at accomplishing some goal

- E.g., knowledge how that actor's epistemology or ethical intuitions would react to close engagement with a particular set of facts

- E.g., if I look carefully at a bunch of info about sentience in nonhumans, given my own worldview and way of processing information, what would I then believe about which nonhumans are conscious, in what ways, and what ethical implications that has?

I think these points might have important implications for the question of giving now vs later (though I haven't given it much thought yet). For example:

- This may push in favour of trying to bring about endogenous learning rather than waiting for exogenous learning

- Trying to bring about endogenous learning (i.e., giving so as to advance the frontiers of humanity's knowledge on a topic) might sometimes also help a philanthropist to advance their own knowledge towards the current or future frontier.

- And/or it might help them advance their knowledge of things specific to themselves.

- It seems less likely that those outcomes would occur if one instead waits for the frontiers to be exogenously advanced.

- Reasons why these things might be true include the following:

- Trying to bring about endogenous learning requires more engagement with the area and the information, so it forces one to get a "headstart towards" or somewhat "keep up with" the frontiers of humanity's knowledge on that area.

- Trying to bring about endogenous learning makes it more valuable to help the philanthropist form accurate views (since they're already giving money in this area), signals that they have "skin in the game", gives them some prominence, etc. This could help them get relevant experts to talk to them, help them attract good grantmakers/researchers, etc.

- I think Open Phil have stated that these sorts of things are a major part of why they want to already give substantial amounts in each area they work in.

- I can't remember where I've seen this written, but I think Holden Karnofsky says something similar in this Q&A.

- This may also push in favour of doing at least a nontrivial amount of giving now rather than later.

- This is for for similar reasons to those given above.

- This may highlight the value of work to "distill" what's already known, so that it can be learned more quickly and with higher fidelity (more nuanced understandings, less misunderstandings, etc.)

As noted, these are just some quick, low-confidence thoughts. (Also, I haven't read the report last year, so I may be forgetting relevant things that the report already says.) I'd be interested to hear Sjir or other people's reactions to these thoughts.

MichaelA @ 2021-03-31T04:23 (+2)

Here's the relevant excerpt from the report:

An advantage of investing to give is that it will allow us to learn about better giving opportunities over time, for instance through improvements in research methodology to detect such giving opportunities.

We should distinguish between two forms of learning — endogenous and exogenous:

- Endogenous learning is learning that Mary brings about herself with her giving, for instance by funding research that helps prioritise amongst causes or by funding experiments with new interventions within a cause. Opportunities for endogenous learning can be a reason for her to give now rather than to invest to give.

- Exogenous learning is learning that occurs regardless of Mary’s giving. It includes advances in the scientific community, new philanthropic interventions being invented and/or tried out by others with similar aims, moral progress, and more. It also captures the time needed for relevant knowledge to become available, e.g. an experiment might take time, research might need to be done in a certain order, or there might be a talent constraint in a research area that takes time to be resolved. When learning is done exogenously, there are advantages to waiting and hence to investing to give.

When Mary puts her funds in the Founders Pledge Investment Fund, she is able to benefit from the long-term-oriented research Founders Pledge does over the next ten years, and from the learnings the Founders Pledge research team derives from external research in that time period. Both of these constitute exogenous learnings from Mary’s perspective.