(Answered) Tax question: Help us donate millions, get a $500 bounty!

By Aaron Gertler 🔸 @ 2021-12-24T06:19 (+35)

Update: The bounty has now been paid out, $500 to each of two people who quickly supplied convincing "yes" answers (one here, one privately).

Hey, Forum!

A small private foundation I work with is struggling with a really hard tax question. Depending on the answer, we may end up giving a lot more this year (vs. many years in the future after the foundation heads retire).

If we get a convincing, well-sourced answer, whoever first shared it will get $500.

(The amount is set a bit low because I'd prefer an answer to be "someone who already knows sharing their knowledge" rather than "an amateur doing hours of research". Since I'm already an amateur doing hours of research, I worry that if I've made a mistake, another amateur might make the same mistake I did. Also, I think the kind of answer I list below will be more likely to convince the foundation heads than research from someone without subject-matter expertise.)

We are most likely to be convinced by an answer if the person sharing it has either dealt with this situation themselves, knows someone who has, can show us a convincing source that refers to a situation closely matching ours, or has experience in tax law.

The question:

- The foundation heads have $1.9 million of adjusted gross income (AGI) to give away this year.

- They want to split this between charitable giving and donations into the foundation, because they haven't yet found $1.9 million in opportunities they like.

- In 2021, cash donations to public charities can be deducted for up to 100% of AGI. That means we could give $1.9 million to charity and have it all be deductible.

- However, cash donations into private foundations can only be deducted up to 30% of AGI. So we can only give $570,000 to the foundation before further donations aren't deductible.

- But if we donate $570,000 to the foundation and $1.33 million to charity, for a total of $1.9 million, is that entire amount still tax-deductible?

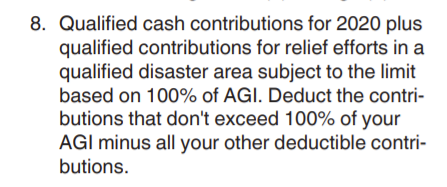

IRS publication 526 seems to imply this. From the leftmost column of page 17:

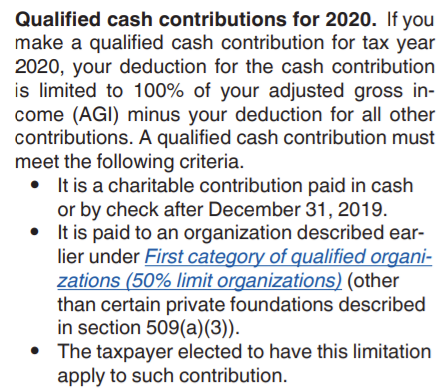

And from page 15:

One accountant we spoke with believes that we can deduct all $1.9 million even if we split it between the foundation and charities, as long as we don't exceed $570,000 in foundation giving.

Another accountant believes that making any contribution to the foundation will "turn off" our ability to make a qualified cash contribution under the 2020/2021 rules, such that our charitable contributions will be subject to the 60% of AGI limit that applied before 2020.

As far as I can tell, the first accountant is right, but I could easily be missing some special exception that would make the second accountant right. I don't have any relevant experience aside from reading the publication (and a bunch of secondary sources that didn't help).

Can anyone help us resolve this?

Stuart Buck @ 2021-12-24T20:32 (+9)

Not a tax lawyer, but I did go to Harvard Law School. It seems to me that the CARES Act (which temporarily extends the charitable contribution limit to 100% of AGI) expressly addresses this sort of situation.

Check out the CARES Act (https://www.congress.gov/116/bills/hr748/BILLS-116hr748enr.pdf), section 2205(a)(1)(A)(i).

That section says:

"Any qualified contribution shall be allowed as a deduction only to the extent that the aggregate of such contributions does not exceed the excess of the taxpayer’s contribution base (as defined in subparagraph (H) of section 170(b)(1) of such Code) over the amount of all other charitable contributions allowed under section 170(b)(1) of such Code."

Let's unpack that a bit.

Any qualified contribution is allowed as a deduction -- that's the starting point. Next, how much can the qualified contributions be? First, look at the "amount of ALL OTHER charitable contributions" allowed under 26 U.S.C. 170(b)(1) -- which is precisely where you're getting the 30% limitation for donations to private foundations (see 170(b)(1)(B)). https://www.law.cornell.edu/uscode/text/26/170

Next, look at the "contribution base" in 170(b)(1)(H) --well, this is simple, because 170(b)(1)(H) just defines "contribution base" as "adjusted gross income (computed without regard to any net operating loss carryback to the taxable year)." If the latter part isn't pertinent to your taxpayer, then we're just talking about AGI here.

Putting it all together, the CARES Act says that you can deduct all qualified contributions up to the amount that your AGI exceeds "all other charitable contributions," which would include the gift to a private foundation.

As an article by Deloitte puts it, "Practically speaking, this means that the deduction for all other types of charitable contributions (e.g., non-cash/property contributions) will be computed and deducted first, based on the taxpayer’s AGI. If there is still AGI remaining to be offset, the taxpayer may elect to take a deduction for the additional qualified cash contributions up to the taxpayer’s entire remaining AGI." https://www.cpajournal.com/2021/06/04/charitable-contribution-benefits-extended-by-the-consolidated-appropriations-act/ See also this article, which talks about "stacking" contributions first to a DAF and then cash up to the amount of AGI: https://www.aefonline.org/blog/stacking-charitable-contributions-2021

And most directly, see this article from tax lawyers at Foley & Lardner (a major national firm with nearly a billion in revenue last year), https://www.foley.com/en/insights/publications/2021/01/the-consolidated-appropriations-act, which says this:

"The AGI limitations can be 'stacked' on one another and each contribution is subject to the separate limit. For instance, a taxpayer could have an AGI of $100 and make a $30 cash gift to a private foundation, a $30 cash gift to a donor advised fund, and a $40 cash to an operating public charity, and all of the deductions would count against income."

Best of luck,

Stuart Buck

Aaron Gertler @ 2021-12-25T00:10 (+2)

Thanks, Stuart! This answer was outstanding. I'll follow up with you privately about the bounty payment.