Spending Update 2022

By Jeff Kaufman 🔸 @ 2022-07-19T14:10 (+35)

Every few years (2020, 2018, 2016, 2014) I like to look over our spending and write something up publicly. General advantages of being public here:

This gives something I can point people to if they have questions about some aspect of how we handle money.

Since almost everything we do either earns or costs money it can be a good overview of our current life situation.

It helps others get a sense of how much things cost.

It lets us see if our spending is changing in ways we might not want, etc.

Let's start with the monthly numbers in the same format as last time. They're either for the whole of 2021 (ex: housing costs) or what we were doing at the end of the year (ex: childcare), whichever gives a more consistent picture. I'm still using the same amortized approach for housing I started in 2018.

- Donations: $33k (51% of 2021 adjusted gross income)

- Taxes: $14k

- Income tax: $7.2k

- State tax: $3.2k

- Social Security tax: $1.6k

- Medicare tax: $1.3k

- Property tax: $708

- Childcare: $5.5k ($250/workday, three kids; $830 pre-tax)

- Housing: $3.7k

- Retirement saving: $4k ($1,625 pre-tax, the rest is after-tax 401k contributions)

- Other savings: $2.5k

- Medical: $1.3k (all pre-tax)

- Food: $668 (two adults, two kids, one infant)

- Other: $1k

- Includes phone bills, taxis, car rentals, clothes, vacation, stuff for the kids, and other smaller expenses.

- Because we are no longer tracking our expenses to the dollar, the distinction between "Other" and "Savings" is an estimate.

- I've doubled this since last time based on a vague guess that we're spending more here.

| Category | pre-tax | post-tax | total |

|---|---|---|---|

| Donations | $0 | $33,000 | $33,000 |

| Retirement | $1,625 | $2,375 | $4,000 |

| Taxes | $0 | $14,000 | $14,000 |

| Housing | $0 | $3,700 | $3,700 |

| Savings | $0 | $2,500 | $2,500 |

| Childcare | $800 | $4,700 | $5,500 |

| Medical | $1,300 | 0 | $1,300 |

| Food | $0 | $668 | $668 |

| Other | $0 | $1,000 | $1,000 |

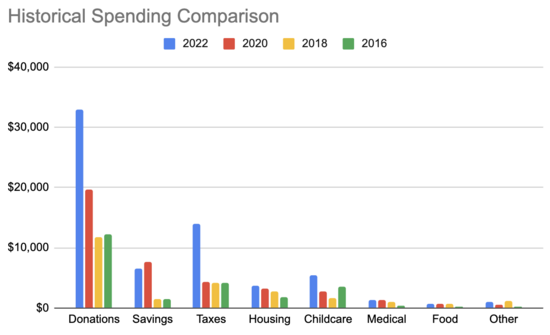

Comparing to previous years:

| 2022 | 2020 | 2018 | 2016 | |

|---|---|---|---|---|

| Donations | $33,000 | $19,600 | $11,800 | $12,200 |

| Savings | $6,500 | $7,700 | $1,500 | $1,500 |

| Taxes | $14,000 | $4,400 | $4,150 | $4,140 |

| Housing | $3,700 | $3,230 | $2,750 | $1,870 |

| Childcare | $5,500 | $2,750 | $1,700 | $3,470 |

| Medical | $1,300 | $1,280 | $950 | $370 |

| Food | $688 | $750 | $750 | $230 |

| Other | $1,000 | $500 | $1,120 | $295 |

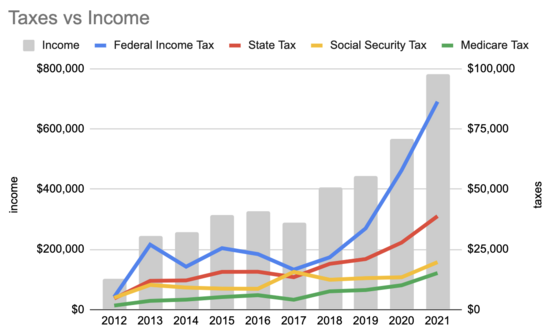

One thing that jumps out is the large increase in taxes, but it's about what you'd expect given the increase in our income and the effect of progressive taxation. Here's the last ten years of income and taxes (note separate left and right axes):

When I write this post in 2024, what do I expect to be saying?

Donations will be down a lot, because I'm no longer earning to give. I haven't decided yet what rate I want to donate now, if at all. I switched roles because I thought my new work would be more valuable than my donations had been, and I'm now making about a quarter of what I made at Google, so there's a sense in which which means I'm effectively 'donating' 75%. While GWWC doesn't count this I'm not convinced that's the right way to handle it. Still thinking on this, and on what sort of EA culture I'd like encourage here.

Savings will be down a lot. Most of our savings were for retirement, and we now have about $600k saved. If we earn a real annual return of 2% over the next 30y (pretty conservative) and retire at 67 then withdrawing 4% a year would be $42k. Combined with us owning our house and being able to rent out parts of it, I'm not planning to put more into our 401k for now.

Taxes will be down a lot; our income will be much lower.

Housing should be about the same. One of our housemates is moving out, but we'll be looking for another.

Childcare should be similar to this year, and will be the largest component of our budget. Our former au pair is now back with the kids as a nanny, and while she's wonderful it's a much more expensive arrangement. It's possible that at some point she might move on, or we might need to switch to something else to save money. This cost should go down in Fall 2026 when our youngest starts Kindergarten, though at that point it's only six more years until 2032 when our oldest starts college.

Other expenses should be similar, though they will be a larger fraction of the budget and we may focus on them more.

Henry Howard @ 2022-07-20T01:01 (+4)

This is really inspiring. I love the openness about your income and spending. The amount you donate is incredible. I don't know how you lived on $688 for food for a year.

Lorenzo @ 2022-07-20T08:07 (+8)

I don't know how you lived on $688 for food for a year.

These are monthly numbers, which makes the donated amount significantly more impressive!