Personal reflections on FTX

By William_MacAskill @ 2024-04-18T09:37 (+235)

The two podcasts where I discuss FTX are now out:

The Sam Harris podcast is more aimed at a general audience; the Spencer Greenberg podcast is more aimed at people already familiar with EA. (I’ve also done another podcast with Chris Anderson from TED that will come out next month, but FTX is a fairly small part of that conversation.)

In this post, I’ll gather together some things I talk about across these podcasts — this includes updates and lessons, and responses to some questions that have been raised on the Forum recently. I’d recommend listening to the podcasts first, but these comments can be read on their own, too. I cover a variety of different topics, so I’ll cover each topic in separate comments underneath this post.

William_MacAskill @ 2024-04-18T11:47 (+161)

On talking about this publicly

A number of people have asked why there hasn’t been more communication around FTX. I’ll explain my own case here; I’m not speaking for others. The upshot is that, honestly, I still feel pretty clueless about what would have been the right decisions, in terms of communications, from both me and from others, including EV, over the course of the last year and a half. I do, strongly, feel like I misjudged how long everything would take, and I really wish I’d gotten myself into the mode of “this will all take years.”

Shortly after the collapse, I drafted a blog post and responses to comments on the Forum. I was also getting a lot of media requests, and I was somewhat sympathetic to the idea of doing podcasts about the collapse — defending EA in the face of the criticism it was getting. My personal legal advice was very opposed to speaking publicly, for reasons I didn’t wholly understand; the reasons were based on a general principle rather than anything to do with me, as they’ve seen a lot of people talk publicly about ongoing cases and it’s gone badly for them, in a variety of ways. (As I’ve learned more, I’ve come to see that this view has a lot of merit to it). I can’t remember EV’s view, though in general it was extremely cautious about communication at that time. I also got mixed comments on whether my Forum posts were even helpful; I haven’t re-read them recently, but I was in a pretty bad headspace at the time. Advisors said that by January things would be clearer. That didn’t seem like that long to wait, and I felt very aware of how little I knew.

The “time at which it’s ok to speak”, according to my advisors, kept getting pushed back. But by March I felt comfortable, personally, about speaking publicly. I had a blog post ready to go, but by this point the Mintz investigation (that is, the investigation that EV had commissioned) had gotten going. Mintz were very opposed to me speaking publicly. I think they said something like that my draft was right on the line where they’d consider resigning from running the investigation if I posted it. They thought the integrity of the investigation would be compromised if I posted, because my public statements might have tainted other witnesses in the investigation, or had a bearing on what they said to the investigators. EV generally wanted to follow Mintz’s view on this, but couldn’t share legal advice with me, so it was hard for me to develop my own sense of the costs and benefits of communicating.

By December, the Mintz report was fully finished and the bankruptcy settlement was completed. I was travelling (vacation and work) over December and January, and aimed to record podcasts on FTX in February. That got delayed by a month because of Sam Harris’s schedule, so they got recorded in March.

It’s still the case that talking about this feels like walking through a minefield. There’s still a real risk of causing unjustified and unfair lawsuits against me or other people or organisations, which, even if frivolous, can impose major financial costs and lasting reputational damage. Other relevant people also don’t want to talk about the topic, even if just for their own sanity, and I don’t want to force their hand. In my own case, thinking and talking about this topic feels like fingering an open wound, so I’m sympathetic to their decision.

Denis @ 2024-04-24T13:12 (+32)

I've had quite a few disagreements with other EA's about this, but I will repeat it here, and maybe get more downvotes. But I've worked for 20 years in a multinational and I know how companies deal with potential reputational damage, and I think we need to at least ask ourselves if it would be wise for us to do differently.

EA is part of a real world which isn't necessarily fair and logical. Our reputation in this real world is vitally important to the good work we plan to do - it impacts our ability to get donations, to carry out projects, to influence policy.

We all believe we're willing to make sacrifices to help EA succeed.

Here's the hard part: Sometimes the sacrifice we have to make is to go against our own natural desire to do what feels right.

It feels right that Will and other people from EA should make public statements about how bad we feel about FTX and how we'll try to do better in future and so on.

But the legal advice Will got was correct, and was also what was best for EA.

There was zero chance that the FTX scandal could reflect positively on EA. But there were steps Will and others could take to minimise the damage to the EA movement.

The most important of these is to distance ourselves from the crimes that SBF committed. He committed those crimes. Not EA. Not Will. SBF caused massive harm to EA and to Will.

I see a lot of EA's soul-searching and asking what we could have done differently. Which is good in a way. But we need to be very careful. Admitting that we (EA movement) should have done better is tantamount to admitting that we did something wrong, which is quickly conflated in public opinion with "SBF and EA are closely intertwined, one and the same." (Remember how low public awareness of EA is in general).

The communication needs to be: EA was defrauded by SBF. He has done us massive harm. We want to make sure nobody will ever do that to EA again. We need to ensure that any public communication puts SBF on one side, and EA on the other side, a victim of his crimes just like the millions of investors.

The fact that he saw himself as an EA is not the point. Nobody in EA encouraged him to commit fraud. People in EA may have been a bit naive, but nobody in EA was guilty of defrauding millions of investors. That was SBF.

So Will's legal advice was spot on. Any immediate statement would have seemed defensive, as if he had something to feel guilty about, which would have resulted in more harm to the public perception of EA because of association with SBF.

- SBF committed crimes.

- Will or EA did not commit crimes, or contribute to SBF's crimes.

- SBF defrauded and harmed millions of investors.

- SBF also defrauded and harmed the EA movement.

- The EA movement is angry with SBF. We want to make sure that nobody ever does that to us again.

As "good people", we all want to look back and ask if there was something we could have done differently that would have prevented Sam from harming those millions of innocent investors. It is natural to wonder, the same way we see any tragedy and wonder if we could have prevented it. But we need to be very careful about the PR aspects of this (and yes, we all hate PR, but it is reality - read Pirandello if you don't believe me!). If we start making statements that suggest that we did something wrong, we're just going to be directing some of the public anger away from SBF and towards EA. I don't think that's helpful.

There is one caveat: if someone acting on behalf on an EA organisation truly did something wrong which contributed to this fraud, then obviously we need to investigate that. But I am not aware of any evidence to suggest that happened.

RyanCarey @ 2024-04-24T16:22 (+53)

There is one caveat: if someone acting on behalf on an EA organisation truly did something wrong which contributed to this fraud, then obviously we need to investigate that. But I am not aware of any evidence to suggest that happened.

I tend to think EA did. Back in September 2023, I argued:

EA contributed to a vast financial fraud, through its:

- People. SBF was the best-known EA, and one of the earliest 1%. FTX’s leadership was mostly EAs. FTXFF was overwhelmingly run by EAs, including EA’s main leader, and another intellectual leader of EA.

- Resources. FTX had some EA staff and was funded by EA investors.

- PR. SBF’s EA-oriented philosophy on giving, and purported frugality served as cover for his unethical nature.

- Ideology. SBF apparently had an RB ideology, as a risk-neutral act-utilitarian, who argued a decade ago why stealing was not in-principle wrong, on Felicifia. In my view, his ideology, at least as he professed it, could best be understood as an extremist variant of EA.

Of course, you can argue that contributing (point 1) people-time and (2) resources is consistent with us having just been victims, although I think that glosses over the extent to which EA folks at FTX had bought into Sam's vision, and folks at FTXFF might have more mildly lapsed in judgment. And we could regard (3) the PR issue as minor. But even so, (4) the ideology is important. FTX wasn't just any scam. It was one that a mostly-EA group was motivated to commit, to some degree or other, based on EA-style/consequentialist reasoning. There were several other instances of crypto-related crimes in and around the EA community. And the FTX implosion shared some characteristics with those events, and with other EA scandals. As I argued:

Other EA scandals, similarly, often involve multiple of these elements:

[Person #1]: past sexual harassment issues, later reputation management including Wiki warring and misleading histories. (norm-violation, naive conseq.)

[Person #2]: sexual harassment (norm-violation? naive conseq?)

[Person #3] [Person #4] [Person #5]: three more instances of crypto crimes (scope sensitivity? Norm-violation, naive conseq.? naivete?)

Intentional Insights: aggressive PR campaigns (norm-violation, naive conseq., naivete?)

Leverage Research, including partial takeover of CEA (risk appetite, norm-violation, naive conseq, unilateralism, naivete)

(We’ve seen major examples of sexual misbehaviour and crypto crimes in the rationalist community too.)

You could argue still that some of these elements are things that are shared with all financial crime. But then why have EAs committed >10% of the largest financial frauds of all-time, while consisting of about one millionth of the world's population, and less than 0.1% and perhaps 0.01% of its startups? You can suppose that we were just unlucky, but I don't find this particularly convincing.

I think that at this point, you should want to concede that EA appears to have contributed to FTX in quite a number of ways, and not all of them can be dismissed easily. That's why I think a more thorough investigation is needed.

As for PR, I simply think that shouldn't be the primary focus, and that it far from the most important consideration on the current margin. First, we need to get the facts in order. And then we need to describe the strategy. And then based on what kind of future EA deserves to have, we could decide how and whether to try to defend its image.

Jason @ 2024-04-24T15:05 (+39)

The communication needs to be: EA was defrauded by SBF. He has done us massive harm. We want to make sure nobody will ever do that to EA again. We need to ensure that any public communication puts SBF on one side, and EA on the other side, a victim of his crimes just like the millions of investors.

Upvoted.

But a problem is: I don't think many people outside of EA believe that, nor will they believe it merely because EA sources self-interestedly repeat it. They do not have priors to believe EA was not somehow responsible for what happened, and the publicly-available evidence (mainly the Time article) points in the direction of at least some degree of responsibility. The more EA proclaims its innocence without coughing up evidence that is credible to the broader world, the more guilty it looks.

But I've worked for 20 years in a multinational and I know how companies deal with potential reputational damage, and I think we need to at least ask ourselves if it would be wise for us to do differently.

Consistency in Following the Usual Playbook

The usual playbook, as I see it, includes shutting up and hope that people lose interest and move on. I accept that there's a reasonable case for deploying the usual playbook. But I don't think you can really pick and choose elements out of that playbook.

For example, one of the standard plays is to quickly throw out most people in the splash zone of the scandal without any real adjudication of their culpability. This serves in part as propitiation to the masses, as well as a legible signal that you're taking the whole thing seriously. It obviates some of the need for a publicly-credible investigation, because you've already expelled anyone for whom there is a reasonable basis to believe culpability might exist. This is true even though the organization knows there is a substantial possibility that the sacrificed individuals were not culpable, or at least not culpable enough to warrant their termination/removal.

Under the standard playbook, at least Will and Nick would be rendered personae non grata very early in the story. Their work is thrown down the memory hole, and neither is spoken of positively for at least several years. None of that is particularly fair or truth-seeking, of course. But I don't think you get to have it both ways -- you can't credibly decline to follow the playbook because it is not truth-seeking and is unfair to certain insiders, and then reject calls for a legible, truth-seeking investigation because it doesn't line up with the playbook. Although people have resigned from boards, and the extent of their "soft power" has been diminished, I don't think EA has followed the standard crisis-management playbook in this regard.

Who Judges the Organization's Crisis Response?

For non-profits, often the judge of the organization's crisis response is the donor base. In most cases, that donor base is much more diverse and less intertwined than it is at (say) EVF. Although donors are not necessarily well-aligned to broader public concerns, the practical requirement that organizations satisfy concerns of their donor base means that the standard playbook includes at least a proxy for taking actions to address public concerns. EVF has had, as far as I can tell, exactly one systematically important donor and that donor is also ~an insider. Compare to, e.g., universities facing heat over alleged antisemitism from various billionaire donors. There's no suggestion that Ackman, Lauder, et al. are in an insider relationship to Penn, MIT, etc. in the same way Open Phil is to EVF. Thus, the standard playbook is generally used under circumstances where there is an baseline business requirement to be somewhat willing to take actions to address a proxy for public concerns.

As I see it, at least some (but not all) of the calls for transparency and investigation are related to a desire for some sort of broader accountability that most non-profits face much more than EA organizations. As far as I can tell, the most suitable analogue to "a medium-size group of donors" for other nonprofits may be "the EA community, many members of which are making large indirect donations in terms of salary sacrifice." The challenge is that discussions with the EA community are public in a way that communications with a group of a few dozen key donors are not for many non-profits.

Nathan Young @ 2024-04-18T22:23 (+7)

Do you think the legal advice was correct? Or is it possible it was wrong to you?

If it was worth spending X millions on community building, feels like it may have been worth risking X/5 on lawsuits to avoid quite a lot of frustration.

It seems like when there is a crisis, the rationalists perhaps talk too much (the SSC NYT thing perhaps) but EA elites clam up and suddenly go all "due diligence" not sure that's the right call either. (Not that I would do better).

Michael_PJ @ 2024-04-19T08:59 (+41)

I feel like "if you get legal advice, follow it" is a pretty widely held and sensible broad principle, and violating it can have very bad personal consequences. I think the bar should be pretty high for someone violating that principle, and I'm not sure "avoiding quite a lot of frustration" meets that bar, especially since the magnitude of the frustration is only obvious in hindsight.

Jason @ 2024-04-19T14:49 (+53)

I have very little doubt that any advice given to an individual with significant potential exposure to keep their mouths shut was correct advice as to that individual's personal interests. I also have very little doubt that anyone who worked for or formally advised FTXFF fits in that category.

To the extent that Nathan is asking about legal advice given to EVF, I don't think the principle would necessarily hold. Legal advice is going to focus relatively more on the client's legal risks, and less so (if at all) on the traditionally-conceived public interest, what is in the interest of the long-term future, etc. I'd say "charitable organizations should act in their own legal self-interest" probably defaults to true, but that it's a fairly weak presumption. With the possible and partial exception of lawyers who are also insiders, I think lawyers will significantly underweight considerations like the epistemic health of the broader EA community and also be seriously limited at estimating the effect of various scenarios on that consideration.

That being said, I doubt Will is in a particularly good position to evaluate the legal advice given to EVF because he was recused from FTX-related stuff due to serious conflicts of interests. If he were a lawyer, he might be in a good position to estimate -- then he'd have both enough knowledge of facts and the right professional background to infer stuff based on that knowledge. But he isn't.

Jason @ 2024-04-18T23:12 (+6)

While this is not expressing an opinion on your broader question, I think the distinction between individual legal exposure and organizational exposure is relevant here. It would be problematic to avoid certain collective costs of FTX by unfairly foisting them off on unconsenting individuals and organizations. As Will alluded to, it is possible that the costs would be borne by other EAs, not the speaker.

That being said, people could be indemnified. So I think it's plausible to update somewhat the probability that there is some valid reason to fear severe to massive legal exposure to some extent. Or that information would come out in litigation that is more damaging than the inferences to be drawn from silence. (Without inside knowledge, I find that more likely than actual severe liability exposure.)

Jonas V @ 2024-04-19T01:23 (+6)

I'd be interested in specific scenarios or bad outcomes that we may have averted. E.g., much more media reporting on the EA-FTX association resulting in significantly greater brand damage? Prompting the legal system into investigating potential EA involvement in the FTX fraud, costing enormous further staff time despite not finding anything? Something else? I'm still not sure what example issues we were protecting against.

Jason @ 2024-04-19T16:07 (+34)

much more media reporting on the EA-FTX association resulting in significantly greater brand damage?

Most likely concern in my eyes.

The media tends to report on lawsuits when they are filed, at which time they merely contain unsubstantiated allegations and the defendant is less likely to comment. It's unlikely that the media would report on the dismissal of a suit, especially if it was for reasons seen as somewhat technical rather than as a clear vindication of the EA individual/organization.

Moreover, it is pretty likely to me that EVF or other EA-affiliated entities have information they would be embarrassed to come out in discovery. This is not based on any belief about misconduct, but the base rate that organizations that had a bad miss / messup have information related thereunto that they would be embarrassed about (and my characterization of a bad miss / messup here, whether or not a liability-creating one).

If a sufficiently motivated plaintiff sued, and came up with a legal theory that survived a motion to dismiss, I think it fairly likely that embarrassing information would need to be disclosed in discovery. They could require various persons and organizations to answer questions, under oath, that they would rather not answer. Questions from a hostile examiner motivated to uncover damaging information, not a sympathetic podcaster. While "I don't remember" is usually an acceptable answer, it also can make the other side's evidence uncontested if they have anything on point.

For purposes of the next two sentences, "a sufficient basis to believe" means enough that a court would likely allow a good deal of digging if the matter was related or even adjacent to something that was material for purposes of the specific litigation. There's a sufficient basis to believe that EA leadership may have had good reasons to believe SBF had committed fraud against Alameda investors.[1] There is a sufficient basis to believe that EA PR people were aware of SBF-related risk and were actively working on the topic.[2] The plaintiff could also expand the scope of discovery as previously-discovered information warranted.

If the case didn't settle before summary-judgment motions, the juicy bits would be all laid out in the plaintiff's motion, open to public view.

Prompting the legal system into investigating potential EA involvement in the FTX fraud, costing enormous further staff time despite not finding anything?

This seems rather unlikely. The FTX debtor entity is cooperating with the feds. DOJ has several ex-insiders who are singing like canaries, who have good lawyers, and who know that the more people they help the feds convict, the better things will be for their sentences. If there were reasons for the feds to be looking at potential EA involvement in the FTX fraud, it is almost certain the feds would know that at this point without any help from EA sources. Moreover, the FTX or ex-insider information would likely be enough to get the necessary search warrants, wiretaps, etc.

There is of course also, as Will's note implies, the distraction/expense/angst/etc. of dealing with litigation, whether or not it ultimately has any merit. That would justify giving some weight to whether a disclosure increases the risk of any lawsuit, independent of any merit or concerns about external adverse effects like publicity. However, in my mind that goes both ways! I'd affirmatively want to disclose most information that makes would-be plaintiffs less likely to sue me. If one's prior is that conditioned on X being not-true, there's a 75% chance I would specifically deny X for litigation-avoidance reasons, then one can update on the fact that X hasn't been denied.

- ^

Although the Time article doesn't specify exactly what information was shared with EA leadership, it does indicate that an Alameda exile told Time that SBF "didn’t have a distinction between firm capital and trading capital. It was all one pool.” That's at least a badge of fraud (commingling). The exiles accused SBF of various things, including “'willful and knowing violations of agreements or obligations, particularly with regards to creditors'—all language that echoes the U.S. criminal code." The document alleges that SBF was “misreporting numbers” and “failing to update investors on poor performance.” Continuing: "The team 'didn’t trust Sam to be in investor meetings alone,' colleagues wrote. 'Sam will lie, and distort the truth for his own gain,' the document says." Lying to investors is pretty much diagnostic of fraud.

- ^

The New Yorker, quoting an unnamed participant on a leadership slack channel: “I guess my point in sharing this is to raise awareness that a) in some circles SBF’s reputation is very bad b) in some circles SBF’s reputation is closely tied to EA, and c) there’s some chance SBF’s reputation gets much, much worse. But I don’t have any data on these (particularly c, I have no idea what types of scenarios are likely), though it seems like a major PR vulnerability. I imagine people working full-time on PR are aware of this and actively working to mitigate it, but it seemed worth passing on if not since many people may not be having these types of interactions.”

Davidmanheim @ 2024-05-02T03:51 (+10)

Alameda exile told Time that SBF "didn’t have a distinction between firm capital and trading capital. It was all one pool.” That's at least a badge of fraud (commingling)

Alameda was a prop trading firm, so there isn't normally any distinction between those. The only reason this didn't apply was that there was a third bucket of funds, pass-through custodial funds that belonged to FTX customers, which they evidently didn't pass through due to poor record keeping. That's not as much indicative of fraud, it's indicative of incompetance.

William_MacAskill @ 2024-04-18T09:47 (+128)

Elon Musk

Stuart Buck asks:

“[W]hy was MacAskill trying to ingratiate himself with Elon Musk so that SBF could put several billion dollars (not even his in the first place) towards buying Twitter? Contributing towards Musk's purchase of Twitter was the best EA use of several billion dollars? That was going to save more lives than any other philanthropic opportunity? Based on what analysis?”

Sam was interested in investing in Twitter because he thought it would be a good investment; it would be a way of making more money for him to give away, rather than a way of “spending” money. Even prior to Musk being interested in acquiring Twitter, Sam mentioned he thought that Twitter was under-monetised; my impression was that that view was pretty widely-held in the tech world. Sam also thought that the blockchain could address the content moderation problem. He wrote about this here, and talked about it here, in spring and summer of 2022. If the idea worked, it could make Twitter somewhat better for the world, too.

I didn’t have strong views on whether either of these opinions were true. My aim was just to introduce the two of them, and let them have a conversation and take it from there.

On “ingratiating”: Musk has pledged to give away at least half his wealth; given his net worth in 2022, that would amount to over $100B. There was a period of time when it looked like he was going to get serious about that commitment, and ramp up his giving significantly. Whether that money was donated well or poorly would be of enormous importance to the world, and that’s why I was in touch with him.

titotal @ 2024-04-18T17:31 (+14)

Sam also thought that the blockchain could address the content moderation problem. He wrote about this here, and talked about it here, in spring and summer of 2022. If the idea worked, it could make Twitter somewhat better for the world, too.

I think this is an indication that the EA community may have hard a hard time seeing through tech hype. I don't think this this is a good sign now we're dealing with AI companies who are also motivated to hype and spin.

The linked idea is very obviously unworkable. I am unsurprised that Elon rejected it and that no similar thing has taken off. First, as usual, it could be done cheaper and easier without a blockchain. second, twitter would be giving people a second place to see their content where they don't see twitters ads, thereby shooting themselves in the foot financially for no reason. Third, while facebook and twitter could maybe cooperate here, there is no point in an interchange between other sites like tiktok and twitter as they are fundamentally different formats. Fourth, there's already a way for people to share tweets on other social media sites: it's called "hyperlinks" and "screenshots". Fifth, how do you delete your bad tweets that are ruining your life is they remain permanently on the blockchain?

Robert_Wiblin @ 2024-04-18T19:00 (+54)

For what it's worth SBF put this idea to me in an interview I did with him and I thought it sounded daft at the time, for the reasons you give among others.

He also suggested putting private messages on the blockchain which seemed even stranger and much less motivated.

That said, at the time I regarded SBF as much more of an expert on blockchain technology than I was, which made me reluctant to entirely dismiss it out of hand, and I endorse that habit of mind.

As it turns out people are now doing a Twitter clone on a blockchain and it has some momentum behind it: https://docs.farcaster.xyz/

So my skepticism may yet be wrong — the world is full of wonders that work even though they seem like they shouldn't. Though how a project like that out-competes Twitter given the network effects holding people onto the platform I don't know.

Lorenzo Buonanno @ 2024-04-18T19:48 (+37)

As a data point, I remember reading that Twitter thread and thinking it didn't make a lot of technical sense (I remember also being worried about the lack of forward secrecy since he wanted to store DMs encrypted on the blockchain).

But the goal was to make a lot of money, not to make a better product, and seeing that DogeCoin and NFTs (which also don't make any technical sense) reached a market cap of tens of billions, it didn't seem completely absurd that shoehorning a blockchain in Twitter made business sense.

My understanding was that crypto should often be thought of as a social technology that enables people to be excited about things that have been possible since the early 2000s. At least that's how I explain to myself how I missed out on BTC and NFTs.

In any case, at the time I thought his main goal must have been to increase the value of FTX (or of Solana), which didn't raise any extra red flags in the reference class of crypto.

Re:

that the EA community may have hard a hard time seeing through tech hype

I think it's important to keep in mind that people could have made at least tens of millions by predicting FTX's collapse, this failure of prediction was really not unique to the EA community, and many in the EA community mentioned plenty of times that the value of FTX could go to 0.

Jonas V @ 2024-04-19T01:52 (+31)

I agree it's probably a pretty bad idea but I don't think this supports your conclusion that "the EA community may have hard a hard time seeing through tech hype"

Elizabeth @ 2024-04-19T17:22 (+29)

I disagree with that quote but I do think the fact that Will is reporting this story now with a straight face is a bad sign.

My steelman would be "look if you think two people would have a positive-sum interaction and it's cheap to facilitate that, doing so is a good default". It's not obvious to me that Will spent more than 30 seconds on this. But the defense is "it was cheap and I didn't think about it very hard", not "Sam had ideas for improving twitter".

Stephen Clare @ 2024-04-22T13:33 (+3)

Your steelman doesn't seem very different from "I didn’t have strong views on whether either of these opinions were true. My aim was just to introduce the two of them, and let them have a conversation and take it from there."

William_MacAskill @ 2024-04-18T09:45 (+124)

What I heard from former Alameda people

A number of people have asked about what I heard and thought about the split at early Alameda. I talk about this on the Spencer podcast, but here’s a summary. I’ll emphasise that this is me speaking about my own experience; I’m not speaking for others.

In early 2018 there was a management dispute at Alameda Research. The company had started to lose money, and a number of people were unhappy with how Sam was running the company. They told Sam they wanted to buy him out and that they’d leave if he didn’t accept their offer; he refused and they left.

I wasn’t involved in the dispute; I heard about it only afterwards. There were claims being made on both sides and I didn’t have a view about who was more in the right, though I was more in touch with people who had left or reduced their investment. That included the investor who was most closely involved in the dispute, who I regarded as the most reliable source.

It’s true that a number of people, at the time, were very unhappy with Sam, and I spoke to them about that. They described him as reckless, uninterested in management, bad at managing conflict, and being unwilling to accept a lower return, instead wanting to double down. In hindsight, this was absolutely a foreshadowing of what was to come. At the time, I believed the view, held by those that left, that Aladema had been a folly project that was going to fail.[1]

As of late 2021, the early Alameda split made me aware that Sam might be difficult to work with. But there are a number of reasons why it didn’t make me think I shouldn’t advise his foundation, or that he might be engaging in fraud.

The main investor who was involved in the 2018 dispute and negotiations — and who I regarded as largely “on the side” of those who left (though since the collapse they’ve emphasised to me they didn’t regard themselves as “taking sides”) — continued to invest in Alameda, though at a lower amount, after the dispute. This made me think that what was at issue, in the dispute, was whether the company was being well-run and would be profitable, not whether Sam was someone one shouldn’t work with.

The view of those that left was that Alameda was going to fail. When, instead, it and FTX were enormously successful, and had received funding from leading VCs like Blackrock and Sequoia, this suggested that those earlier views had been mistaken, or that Sam had learned lessons and matured over the intervening years. I thought this view was held by a number of people who’d left Alameda; since the collapse I checked with several of those who left, who have confirmed that was their view.[2]

This picture was supported by actions taken by people who’d previously worked at Alameda. Over the course of 2022, former Alameda employees, investors or advisors with former grievances against Sam did things like: advise Future Fund, work as a Future Fund regranter, accept a grant from Future Fund, congratulate Nick on his new position, trade on FTX, or even hold a significant fraction of their net worth on FTX. People who left early Alameda, including very core people, were asked for advice prior to working for FTX Foundation by people who had offers to work there; as far as I know, none of them advised against working for Sam.

I was also in contact with a few former Alameda people over 2022: as far as I remember, none of them raised concerns to me. And shortly after the collapse, one of the very most core people who left early Alameda, with probably the most animosity towards Sam, messaged me to say that they were as surprised as anyone, that they thought it was reasonable to regard the early Alameda split as a typical cofounder fallout, and that even they had come to think that Alameda and FTX had overcome their early issues and so they had started to trade on FTX.[3][4]

I wish I’d been able to clear this up as soon as the TIME article was released, and I’m sorry that this means there’s been such a long period of people having question marks about this. There was a failure where at the time I thought I was going to be able to talk publicly about this just a few weeks later, but then that moment in time kept getting delayed.

- ^

Sam was on the board of CEA US at the time (early 2018). Around that time, after the dispute, I asked the investor that I was in touch with whether Sam should be removed from the board, and the investor said there was no need. A CEA employee (who wasn't connected to Alameda) brought up the idea that Sam should transition off the board, because he didn't help improve diversity of the board, didn't provide unique skills or experience, and that CEA now employed former Alameda employees who were unhappy with him. Over the course of the year that followed, Sam was also becoming busier and less available. In mid-2019, we decided to start to reform the board, and Sam agreed to step down.

- ^

In addition, one former Alameda employee, who I was not particularly in touch with, made the following comment in March 2023. It was a comment on a private googledoc (written by someone other than me), but they gave me permission to share:

"If you’d asked me about Sam six months ago I probably would have said something like “He plays hardball and is kind of miserable to work under if you want to be treated as an equal, but not obviously more so than other successful business people.” (Think Elon Musk, etc.)

"Personally, I’m not willing to be an asshole in order to be successful, but he’s the one with the billions and he comprehensively won on our biggest concrete disagreements so shrug. Maybe he reformed, or maybe this is how you have to be.”

As far as I was concerned that impression was mostly relevant to people considering working with or for Sam directly, and I shared it pretty freely when that came up.

Saying anything more negative still feels like it would have been a tremendous failure to update after reality turned out not at all like I thought it would when I left Alameda in 2018 (I thought Alameda would blow up and that FTX was a bad idea which played to none of our strengths).

Basically I think this and other sections [of the googledoc] are acting like people had current knowledge of bad behaviour which they feared sharing, as opposed to historical knowledge of bad behaviour which tended to be accompanied by doomy predictions that seemed to have been comprehensively proven false. Certainly I had just conceded epistemic defeat on this issue."

- ^

They also thought, though, that the FTX collapse should warrant serious reflection about the culture in EA.

- ^

On an older draft of this comment (which was substantively similar) I asked several people who left Alameda in 2018 (or reduced their investment) to check the above six paragraphs, and they told me they thought the paragraphs were accurate.

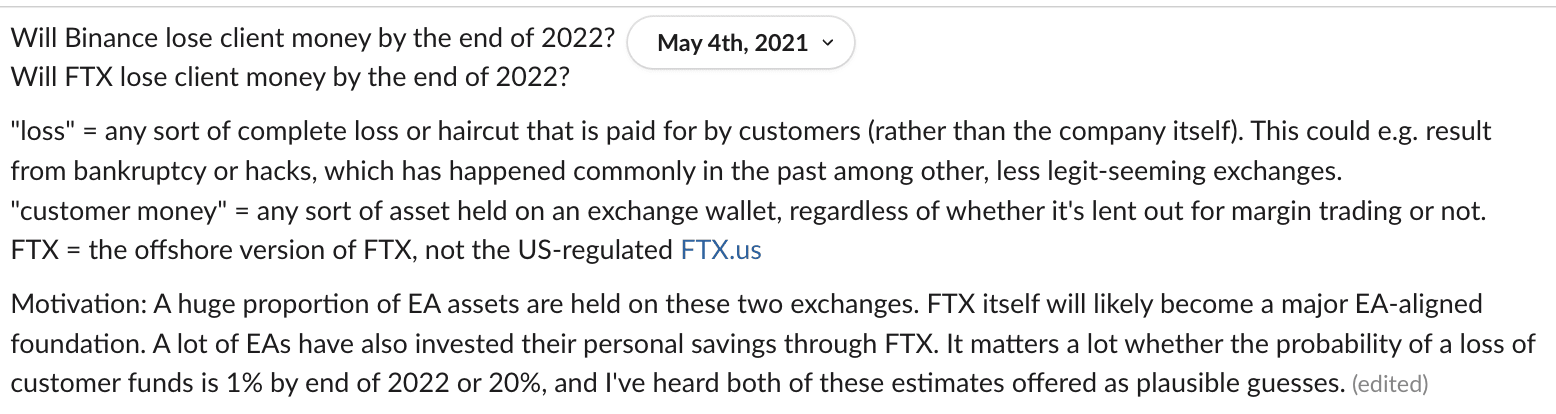

Jonas V @ 2024-04-18T16:53 (+109)

I broadly agree with the picture and it matches my perception.

That said, I'm also aware of specific people who held significant reservations about SBF and FTX throughout the end of 2021 (though perhaps not in 2022 anymore), based on information that was distinct from the 2018 disputes. This involved things like:

- predicting a 10% annual risk of FTX collapsing with

FTX investors and the Future Fund (though not customers)FTX investors, the Future Fund, and possibly customers losing all of their money,- [edit: I checked my prediction logs and I actually did predict a 10% annual risk of loss of customer funds in November 2021, though I lowered that to 5% in March 2022. Note that I predicted hacks and investment losses, but not fraud.]

- recommending in favor of 'Future Fund' and against 'FTX Future Fund' or 'FTX Foundation' branding, and against further affiliation with SBF,

- warnings that FTX was spending its US dollar assets recklessly, including propping up the price of its own tokens by purchasing large amounts of them on open markets (separate from the official buy & burns),

- concerns about Sam continuing to employ very risky and reckless business practices throughout 2021.

I think several people had pieces of the puzzle but failed to put them together or realize the significance of it all. E.g. I told a specific person about all of the above issues, but they didn't have a 'holy shit' reaction, and when I later checked with them they had forgotten most of the information I had shared with them.

I also tried to make several further conversations about these concerns happen, but it was pretty hard because many people were often busy and not interested, or worried about the significant risks from sharing sensitive information. Also, with the benefit of hindsight, I clearly didn't try hard enough.

I also think it was (and I think still is) pretty unclear what, if anything, should've been done at the time, so it's unclear how action-relevant any of this would've been.

It's possible that most of this didn't reach Will (perhaps partly because many, including myself, perceived him as more of an SBF supporter). I certainly don't think these worries were as widely disseminated as they should've been.

huw @ 2024-04-19T04:12 (+57)

A meta thing that frustrates me here is I haven’t seen much talking about incentive structures. The obvious retort to negative anecdotal evidence is the anecdotal evidence Will cited about people who had previous expressed concerns who continued to affiliate with FTX and the FTXFF, but to me, this evidence is completely meaningless because continuing to affiliate with FTX and FTXFF meant a closer proximity to money. As a corollary, the people who refused to affiliate with them did so at significant personal & professional cost for that two-year period.

Of course you had a hard time voicing these concerns! Everyone’s salaries depended on them not knowing or disseminating this information! (I am not here to accuse anyone of a cover-up, these things usually happen much less perniciously and much more subconsciously)

Ben_West @ 2024-04-19T16:20 (+18)

predicting a 10% annual risk of FTX collapsing with FTX investors and the Future Fund (though not customers) losing all of their money,

Do you know if this person made any money off of this prediction? I know that shorting cryptocurrency is challenging, and maybe the annual fee from taking the short side of a perpetual future would be larger than 10%, not sure, but surely once the FTX balance sheet started circulating that should have increased the odds that the collapse would happen on a short time scale enough for this trade to be profitable?[1]

I feel like I asked you this before but I forgot the answer, sorry. ↩︎

Jonas V @ 2024-04-19T21:34 (+18)

I don't think so, because:

- A 10–15% annual risk was predicted by a bunch of people up until late 2021, but I'm not aware of anyone believing that in late 2022, and Will points out that Metaculus was predicting ~1.3% at the time. I personally updated downwards on the risk because 1) crypto markets crashed, but FTX didn't, which seems like a positive sign, 2) Sequoia invested, 3) they got a GAAP audit.

- I don't think there was a great implementation of the trade. Shorting FTT on Binance was probably a decent way to do it, but holding funds on Binance for that purpose is risky and costly in itself.

That said, I'm aware that some people (not including myself) closely monitored the balance sheet issue and subsequent FTT liquidations, and withdrew their full balances a couple days before the collapse.

Lorenzo Buonanno @ 2024-04-20T12:18 (+27)

Is a 10-15% annual risk of failure for a two-year-old startup alarming? I thought base rates were higher, which makes me think I'm misunderstanding your comment.

You also mention that the 10% was without loss of costumer funds, but the Metaculus 1.3% was about loss of costumer funds, which seems very different.

10% chance of yearly failure without loss of customer funds seems more than reasonable, even after Sequoia invested, in such a high-variance environment, and not necessarily a red flag.

Jonas V @ 2024-04-21T18:41 (+11)

A 10-15% annual risk of startup failure is not alarming, but a comparable risk of it losing customer funds is. Your comment prompted me to actually check my prediction logs, and I made the following edit to my original comment:

- predicting a 10% annual risk of FTX collapsing with

FTX investors and the Future Fund (though not customers)FTX investors, the Future Fund, and possibly customers losing all of their money,

- [edit: I checked my prediction logs and I actually did predict a 10% annual risk of loss of customer funds in November 2021, though I lowered that to 5% in March 2022. Note that I predicted hacks and investment losses, but not fraud.]

Jason @ 2024-04-20T12:39 (+7)

Is the better reference class "two-year old startups" or "companies supposedly worth over $10B" or "startups with over a billion invested"? I assume a 100 percent investor loss would be rare, on an annualized basis, in the latter two -- but was included in the original claim. Most two-year startups don't have nearly the amount of investor money on board that FTX did.

Ben_West @ 2024-04-20T18:46 (+2)

Thanks! That's helpful. In particular, I wasn't tracking the 2021 versus 2022 thing.

Jonas V @ 2024-04-21T18:43 (+2)

(See my edit)

Jason @ 2024-04-19T19:52 (+4)

Optics would be great on that one -- an EA has insight that there's a good chance of FTX collapse (based on not generally-known info / rumors?), goes out and shorts SamCoins to profit on the collapse! Recall that any FTX collapse would gut the FTT token at least, so there would still be big customer losses.

Davidmanheim @ 2024-05-02T04:02 (+6)

Gutting the FTT token is customers losing money because of their investing, not customer losses via FTX loss of custodial funds or token, though, isn't it?

Jonas V @ 2024-04-21T18:51 (+12)

Based on some of the follow-up questions, I decided to share this specific example of my thinking at the time (which didn't prevent me from losing some of my savings in the bankruptcy):

Jason @ 2024-04-21T19:17 (+4)

Do you recall what your conception of a possible customer loss resulting "from bankruptcy" was, and in particular whether it was (at least largely) limited to "monies lent out for margin trading"? Although I haven't done any research, if user accounts had been appropriately segregated and safeguarded, FTX's creditors (in a hypothetical "normal" bankruptcy scenario) shouldn't have been able to make claims against them. There might have been an exception for those involved in margin trading

Jonas V @ 2024-04-21T19:47 (+6)

I recall feeling most worried about hacks resulting in loss of customer funds, including funds not lent out for margin trading. I was also worried about risky investments or trades resulting in depleting cash reservers that could be used to make up for hacking losses.

I don't think I ever generated the thought "customer monies need to be segregated, and they might not be", primarily because at the time I wasn't familiar with financial regulations.

E.g. in 2023 I ran across an article written in ~2018 that commented an SIPC payout in a case of a broker co-mingling customer funds with an associated trading firm. If I had read that article in 2021, I would have probably suspected FTX of doing this.

AnonymousEAForumAccount @ 2024-04-23T14:15 (+40)

Thanks for writing up these thoughts Will, it is great to see you weighing in on these topics.

I’m unclear on one point (related to Elizabeth’s comments) around what you heard from former Alameda employees when you were initially learning about the dispute. Did you hear any concerns specifically about Sam’s unethical behavior, and if so, did these concerns constitute a nontrivial share of the total concerns you heard?

I ask because in this comment and on Spencer’s podcast (at ~00:13:32), you characterize the concerns you heard about almost identically. In both cases, you mention a bunch of specific concerns you had heard (company was losing money, Sam’s too risky, he’s a bad manager, he wanted to double down rather than accept a lower return), but they all relate to Sam’s business acumen/competence and there’s no mention of ethical issues. So I’m hoping you can clarify why there’s a discrepancy with Time’s reporting, which specifically mentions that ethical concerns were a significant point of emphasis and that these were communicated directly to you:

[Alameda co-founders wrote a document that] “accuses Bankman-Fried of dismissing calls for stronger accounting and inflating the expected value of adding new exchanges, and said a majority of employees thought he was “negligent” and “unethical.” It also alleges he was “misreporting numbers” and “failing to update investors on poor performance.” The team “didn’t trust Sam to be in investor meetings alone,” colleagues wrote. “Sam will lie, and distort the truth for his own gain,” the document says.

…Mac Aulay and others warned MacAskill, Beckstead and Karnofsky about her co-founder’s alleged duplicity and unscrupulous business ethics, according to four people with knowledge of those discussions. Mac Aulay specifically flagged her concerns about Bankman-Fried’s honesty and trustworthiness, his maneuvering to control 100% of the company despite promising otherwise, his pattern of unethical behavior, and his inappropriate relationships with subordinates, sources say.

Nathan Young @ 2024-04-18T22:27 (+25)

It seems there was a lot of information floating around but no one saw it as their responsibility to check whether SBF was fine and there was no central person for information to be given to. Is that correct?

Has anything been done to change this going forward?

Jonas V @ 2024-04-19T01:25 (+27)

From personal experience, I thought community health would be responsible, and approached them about some concerns I had, but they were under-resourced in several ways.

Ben Millwood @ 2024-04-22T08:51 (+26)

I normally think of community health as dealing with interpersonal stuff, and wouldn't have expected them to be equipped to evaluate whether a business was being run responsibly. It seems closer to some of the stuff they're doing now, but at the time the team was pretty constrained by available staff time (and finding it difficult to hire), so I wouldn't expect them to have been doing anything outside of their core competency.

Maybe a lesson is that we should be / should have been clearer about scopes, so there's more of an opportunity to notice when something doesn't belong to anyone?

Guy Raveh @ 2024-04-22T09:19 (+10)

I'd argue that "checking whether businesses are run responsibly" is out of scope for EA in general.

Jason @ 2024-04-22T12:54 (+13)

I think the fitness/suitability of major leaders (at least to the extent we are talking about a time when SBF was on the board) and major donor acceptability evaluation are inherently in scope for any charitable organization or movement.

Guy Raveh @ 2024-04-22T20:15 (+8)

Do most charitable organizations have in-house people to examine donors? I'm not saying we shouldn't check, but rather that there shouldn't be people in EA organizations whose job is to do this - rather than organizations just hiring auditors or whomever to do it for them.

Aleks_K @ 2024-04-23T12:13 (+9)

Charitable organisations generally do due diligence on large donors and will most likely do this in-house in most cases (perhaps with some external support) - very large organisations (eg Universities) will usually have a specialised in-house team independent from the rest of the operations to do this. It is also likely that at least the larger EA organisations did do due diligence on donations from Sam/FTX, they just decided on balance that it's fine to take the donation.

AnonymousEAForumAccount @ 2024-04-23T14:20 (+15)

EV should have due diligence processes in place, instigated by EA's first encounter with a disgraced crypto billionaire/major EA donor (Ben Delo).

In February 2021, CEA (the EV rebrand hadn't happened yet) wrote:

Here’s an update from CEA's operations team, which has been working on updating our practices for handling donations. This also applies to other organizations that are legally within CEA (80,000 Hours, Giving What We Can, Forethought Foundation, and EA Funds).

- “We are working with our lawyers to devise and implement an overarching policy for due diligence on all of our donors and donations going forward.

- We've engaged a third party who now conducts KYC (know your client) due diligence research on all major donors (>$20K a year).

- We have established a working relationship with TRM who conduct compliance and back-tracing for all crypto donations.

Jason @ 2024-04-23T16:28 (+4)

It's unclear from that whether the due diligence scaled appropriately with size of donation. I doubt ~anyone is batting an eye at charities that took 25K-50K from SBF, due diligence or no. The process at the tens of millions per year level needs to be bespoke, though.

AnonymousEAForumAccount @ 2024-04-23T22:34 (+3)

Yeah, fully agree with this. I hope now that EV and/or EV-affiliated people are talking more about this matter that they'll be willing to share what specific due diligence was done before accepting SBF's gifts and what their due diligence policies look like more generally.

Jason @ 2024-04-22T22:40 (+2)

Unclear, although most nonprofits are attracting significantly less risky donors than crypto people. (SBF wasn't even the first crypto scammer sentenced to a multidecade term in the Southern District of New York in the past twelve months....)

I'd suggest that even to the extent a non-profit is generally outsourcing that kind of work, it can't just rely on standard third-party practices where significant information with some indicia of reliability is brought directly to it.

Ben Millwood @ 2024-04-22T11:24 (+4)

I don't think the EA movement as a whole can sensibly be assigned a scope, really. But I think we should collectively be open to doing whatever reasonably practicable, ethical things seem most important, without restricting ourselves to only certain kinds of behaviour fitting that description.

Guy Raveh @ 2024-04-22T20:17 (+8)

I definitely agree. But I think we're far from it being practically useful for dedicated EAs to do this themselves.

RyanCarey @ 2024-04-19T11:07 (+3)

This is who I thought would be responsible too, along with the CEO of CEA, that they report to, (and those working for the FTX Future Fund, although their conflictedness means they can't give an unbiased evaluation). But since the FTX catastrophe, the community health team has apparently broadened their mandate to include "epistemic health" and "Special Projects", rather than narrowing it to focus just on catastrophic risks to the community, which would seem to make EA less resilient in one regard, than it was before.

Of course I'm not necessarily saying that it was possible to put the pieces together ahead of time, just that if there was one group responsible for trying, they were it.

AnotherAnonymousFTXAccount @ 2024-04-19T11:30 (+26)

Surely one obvious person with this responsibility was Nick Beckstead, who became President of the FTX Foundation in November 2021. That was the key period where EA partnered with FTX. Beckstead had long experience in grantmaking, credibility, and presumably incentive/ability to do due diligence. Seems clear to me from these podcasts that MacAskill (and to a lesser extent the more junior employees who joined later) deferred to Beckstead.

RyanCarey @ 2024-04-19T11:44 (+7)

Yes, that's who I meant when I said "those working for the FTX Future Fund"

Elizabeth @ 2024-04-19T17:29 (+18)

My understanding is that this wasn't a benign management dispute, it was an ethical dispute about whether to disclose to investors that Alameda had misplaced $4m. SBF's refusal to do so sure seems of a piece with FTX's later issues.

Ben_West @ 2024-04-22T17:27 (+22)

I do not remember being entirely or even primarily motivated by that issue. I'm not sure where Matt is getting this from, though in his defense he's writing pretty flippantly.

Elizabeth @ 2024-04-22T21:52 (+23)

Matt Levine is quoting from Going Infinite. I do not know who Michael Lewis's source is. I've heard confirming bits and pieces privately, which makes me trust this public version more. Of course that doesn't mean that was everyone's motivation: I'd be very interested to hear whatever you're able to share.

Ben_West @ 2024-04-23T23:58 (+28)

Thanks, that makes sense. I didn't remember Going Infinite as having made such a strong claim, but maybe I was projecting my own knowledge into the book.

I looked back at the agenda for our resignation/buyout meeting and I don't see anything like "didn't disclose misplaced transfer money to investors". Which doesn't mean that no one had this concern, only that they didn't add it to the agenda, but I do think it would be misleading to describe this as the central concern of the management team, given that we listed other things in the agenda instead of that.[1]

- ^

To preempt a question about what concerns I did have, if not the transfer thing: see my post from last year:

I thought Sam was a bad CEO. I think he literally never prepared for a single one-on-one we had, his habit of playing video games instead of talking to you was “quirky” when he was a billionaire but aggravating when he was my manager, and my recollection is that Alameda made less money in the time I was there than if it had just simply bought and held bitcoin.

I'm not sure if I would describe the above as a "benign management dispute" (it certainly didn't feel benign to me at the time), but I think it's even less accurate to describe it as being about the misplaced transfers

Elizabeth @ 2024-04-24T03:46 (+3)

that makes sense, sounds like it wasn't the concern for at least your group. He does describe it as "The rest of the management team was horrified and quit in a huff, loudly telling the investors that Bankman-Fried was dishonest and reckless", so unless there were multiple waves of management quitting it sounds like the book conflated multiple stories.

Lorenzo Buonanno @ 2024-04-24T11:49 (+29)

Just to clarify, it seems that "The rest of the management team was horrified and quit in a huff, loudly telling the investors that Bankman-Fried was dishonest and reckless" is from Matt Levine, not from Michael Lewis.

I'm quickly skimming the relevant parts of Going Infinite, and it seems to me that Lewis highlights other issues as even more relevant than the missing $4M

Angelina Li @ 2024-05-20T12:04 (+4)

Unrelated — I really like this comment + this other comment of yours as good examples of: "I notice the disagreement you are having is about an empirical and easily testable question, let me spend 5 min to grab the nearest data to test this." (I really admire / value this virtue <3 )

Ben Millwood @ 2024-04-22T08:53 (+5)

I think this was an example of a disagreement they had, but not the whole disagreement. (Another alleged example was the thing where Tara didn't want Sam to run some trading algorithm unattended, which he agreed to and then did anyway.)

Elizabeth @ 2024-04-22T22:07 (+22)

There part where SBF committed to something important in his trading company and then broke the agreement also seems more predictive of fraud than suggested by the phrase "management dispute".

People rarely leave over one thing and different people leave over different reasons. But I expect people hearing "left over ethics disputes" to walk away with a more accurate understanding than "left over a management dispute" (and more details to either sentence would be welcome).

Ben Millwood @ 2024-04-23T10:12 (+2)

Yeah sorry I didn't intend to disagree with you on whether it was a management dispute or an ethics dispute, just that it wasn't only the issue you explicitly named.

Habryka @ 2024-04-18T19:30 (+103)

Thank you Will! This is very much the kind of reflection and updates that I was hoping to see from you and other leaders in EA for a while.

I do hope that the momentum for translating these reflections into changes within the EA community is not completely gone given the ~1.5 years that have passed since the FTX collapse, but something like this feels like a solid component of a post-FTX response.

I disagree with a bunch of object-level takes you express here, but your reflections seem genuine and productive and I feel like me and others can engage with them in good faith. I am grateful for that.

William_MacAskill @ 2024-04-18T09:39 (+99)

Lessons and updates

The scale of the harm from the fraud committed by Sam Bankman-Fried and the others at FTX and Alameda is difficult to comprehend. Over a million people lost money; dozens of projects’ plans were thrown into disarray because they could not use funding they had received or were promised; the reputational damage to EA has made the good that thousands of honest, morally motivated people are trying to do that much harder. On any reasonable understanding of what happened, what they did was deplorable. I’m horrified by the fact that I was Sam’s entry point into EA.

In these comments, I offer my thoughts, but I don’t claim to be the expert on the lessons we should take from this disaster. Sam and the others harmed me and people and projects I love, more than anyone else has done in my life. I was lied to, extensively, by people I thought were my friends and allies, in a way I’ve found hard to come to terms with. Even though a year and a half has passed, it’s still emotionally raw for me: I’m trying to be objective and dispassionate, but I’m aware that this might hinder me.

There are four categories of lessons and updates:

- Undoing updates made because of FTX

- Appreciating the new world we’re in

- Assessing what changes we could make in EA to make catastrophes like this less likely to happen again

- Assessing what changes we could make such that EA could handle crises better in the future

On the first two points, the post from Ben Todd is good, though I don’t agree with all of what he says. In my view, the most important lessons when it comes to the first two points, which also have bearing on the third and fourth, are:

- Against “EA exceptionalism”: without evidence to the contrary, we should assume that people in EA are about average (given their demographics) on traits that don’t relate to EA. Sadly, that includes things like likelihood to commit crimes. We should be especially cautious to avoid a halo effect — assuming that because someone is good in some ways, like being dedicated to helping others, then they are good in other ways, too, like having integrity.

- Looking back, there was a crazy halo effect around Sam, and I’m sure that will have influenced how I saw him. Before advising Future Fund, I remember asking a successful crypto investor — not connected to EA — what they thought of him. Their reply was: “He is a god.”

- In my own case, I think I’ve been too trusting of people, and in general too unwilling to countenance the idea that someone might be a bad actor, or be deceiving me. Given what we know now, it was obviously a mistake to trust Sam and the others, but I think I've been too trusting in other instances in my life, too. I think in particular that I’ve been too quick to assume that, because someone indicates they’re part of the EA team, they are thereby trustworthy and honest. I think that fully improving on this trait will take a long time for me, and I’m going to bear this in mind in which roles I take on in the future.

- Presenting EA in the context of the whole of morality.

- EA is compatible with very many different moral worldviews, and this ecumenicism was a core reason for why EA was defined as it was. But people have often conflated EA with naive utilitarianism: that promoting wellbeing is the *only* thing that matters.

- Even on pure utilitarian grounds, you should take seriously the wisdom enshrined in common-sense moral norms, and be extremely sceptical if your reasoning leads you to depart wildly from them. There are very strong consequentialist reasons for acting with integrity and for being cooperative with people with other moral views.

- But, what’s more, utilitarianism is just one plausible moral view among many, and we shouldn’t be at all confident in it. Taking moral uncertainty into account means taking seriously the consequences of your actions, but it also means respecting common-sense moral prohibitions.[1]

- I could have done better in how I’ve communicated on this score. In the past, I’ve emphasised the distinctive aspects of EA, treated the conflation with naive utilitarianism as a confusion that people have, and the response to it as an afterthought, rather than something built into the core of talking about the ideas. I plan to change that, going forward — emphasising more the whole of morality, rather than just the most distinctive contributions that EA makes (namely, that we should be a lot more benevolent and a lot more intensely truth-seeking than common-sense morality suggests).

- Going even further on legibly acting in accordance with common-sense virtues than one would otherwise, because onlookers will be more sceptical of people associated with EA than they were before.

- Here’s an analogy I’ve found helpful. Suppose it’s a 30mph zone, where almost everyone in fact drives at 35mph. If you’re an EA, how fast should you drive? Maybe before it was ok to go at 35, in line with prevailing norms. Now I think we should go at 30.

- Being willing to fight for EA qua EA.

- FTX has given people an enormous stick to hit EA with, and means that a lot of people have wanted to disassociate from EA. This will result in less work going towards the most important problems in the world today - yet another of the harms that Sam and the others caused.

- But it means we’ll need, more than ever, for people who believe that the ideas are true and important to be willing to stick up for them, even in the face of criticism that’s often unfair and uncharitable, and sometimes downright mean.

On the third point — how to reduce the chance of future catastrophes — the key thing, in my view, is to pay attention to people’s local incentives when trying to predict their behaviour, in particular looking at the governance regime they are in. Some of my concrete lessons, here, are:

- You can’t trust VCs or the financial media to detect fraud.[2] (Indeed, you shouldn’t even expect VCs to be particularly good at detecting fraud, as it’s often not in their self-interest to do so; I found Jeff Kaufman’s post on this very helpful).

- The base rates of fraud are surprisingly high (here and here).

- We should expect the base rate to be higher in poorly-regulated industries.

- The idea that a company is run by “good people” isn't sufficient to counterbalance that.

- In general, people who commit white collar crimes often have good reputations before the crime; this is one of the main lessons from Eugene Soltes’s book Why They Do It.

- In the case of FTX: the fraud was committed by Caroline, Gary and Nishad, as well as Sam. Though some people had misgivings about Sam, I haven’t heard the same about the others. In Nishad’s case in particular, comments I’ve heard about his character are universally that he seemed kind, thoughtful and honest. Yet, that wasn’t enough.

- (This is all particularly on my mind when thinking about the future behaviour of AI companies, though recent events also show how hard it is to get governance right so that it’s genuinely a check on power.)

- In the case of FTX, if there had been better aggregation of people’s opinions on Sam that might have helped a bit, though as I note in another comment there was a widespread error in thinking that the 2018 misgivings were wrong or that he’d matured. But what would have helped a lot more, in my view, was knowing how poorly-governed the company was — there wasn’t a functional board, or a risk department, or a CFO.

On how to respond better to crises in the future…. I think there’s a lot. I currently have no formal responsibilities over any community organisations, and do limited informal advising, too,[3] so I’ll primarily let Zach (once he’s back from vacation) or others comment in more depth on lessons learned from this, as well as changes that are being made, and planned to be made, across the EA community as a whole.

But one of the biggest lessons, for me, is decentralisation, and ensuring that people and organisations to a greater extent have clear separation in their roles and activities than they have had in the past. I wrote about this more here. (Since writing that post, though, I now lean more towards thinking that someone should “own” managing the movement, and that that should be the Centre for Effective Altruism. This is because there are gains from “public goods” in the movement that won't be provided by default, and because I think Zach is going to be a strong CEO who can plausibly pull it off.)

In my own case, at the point of time of the FTX collapse, I was:

- On the board of EV

- An advisor to Future Fund

- The most well-known advocate of EA

But once FTX collapsed, these roles interfered with each other. In particular, being on the board of EV and an advisor to Future Fund majorly impacted my ability to defend EA in the aftermath of the collapse and to help the movement try to make sense of what had happened. In retrospect, I wish I’d started building up a larger board for EV (then CEA), and transitioned out of that role, as early as 2017 or 2018; this would have made the movement as a whole more robust.

Looking forward, I’m going to stay off boards for a while, and focus on research, writing and advocacy.

- ^

I give my high-level take on what generally follows from taking moral uncertainty seriously, here: “In general, and very roughly speaking, I believe that maximizing expected choice- worthiness under moral uncertainty entails something similar to a value-pluralist consequentialism-plus-side-constraints view, with heavy emphasis on consequences that impact the long-run future of the human race.”

- ^

There’s a knock against prediction markets, here, too. A Metaculus forecast, in March of 2022 (the end of the period when one could make forecasts on this question), gave a 1.3% chance of FTX making any default on customer funds over the year. The probability that the Metaculus forecasters would have put on the claim that FTX would default on very large numbers of customer funds, as a result of misconduct, would presumably have been lower.

- ^

More generally, I’m trying to emphasise that I am not the “leader” of the EA movement, and, indeed, that I don’t think that the EA movement is the sort of thing that should have a leader. I’m still in favour of EA having advocates (and, hopefully, very many advocates, including people who hopefully get a lot more well-known than I am), and I plan to continue to advocate for EA, but I see that as a very different role.

Jonas V @ 2024-04-19T01:44 (+67)

- Going even further on legibly acting in accordance with common-sense virtues than one would otherwise, because onlookers will be more sceptical of people associated with EA than they were before.

- Here’s an analogy I’ve found helpful. Suppose it’s a 30mph zone, where almost everyone in fact drives at 35mph. If you’re an EA, how fast should you drive? Maybe before it was ok to go at 35, in line with prevailing norms. Now I think we should go at 30.

Wanting to push back against this a little bit:

- The big issue here is that SBF was recklessly racing ahead at 60mph, and EAs who saw that didn't prevent him from doing so. So, I think the main lesson here is that EAs should learn to become strict enforcers of 35mph speed limits among their collaborators, which requires courage and skill in speaking out, rather than being highly strictly law-abiding.

- The vast majority of EAs were/are reasonably law-abiding and careful (going at 35mph) and it seems perfectly fine for them to continue the same way. Extra trustworthiness signalling is helpful insofar as the world distrusts EAs due to what happened at FTX, but this effect is probably not huge.

- EAs will get less done, be worse collaborators, and lose out on entrepreneurial talent if they become overly cautious. A non-zero level of naughtiness is often desirable, though this is highly domain-dependent.

Ben Millwood @ 2024-04-20T19:09 (+6)

I hear Will not as saying that going 35mph is in itself wrong in this analogy (necessarily), but that EA is now more-than-average vulnerable to attack and mistrust, so we need to signal our trustworthiness more clearly than others do.

RobBensinger @ 2024-04-20T01:13 (+60)

Since writing that post, though, I now lean more towards thinking that someone should “own” managing the movement, and that that should be the Centre for Effective Altruism.

I agree with this. Failing that, I feel strongly that CEA should change its name. There are costs to having a leader / manager / "coordinator-in-chief", and costs to not having such an entity; but the worst of both worlds is to have ambiguity about whether a person or org is filling that role. Then you end up with situations like "a bunch of EAs sit on their hands because they expect someone else to respond, but no one actually takes the wheel", or "an org gets the power of perceived leadership, but has limited accountability because it's left itself a lot of plausible deniability about exactly how much of a leader it is".

Nathan Young @ 2024-04-18T22:38 (+17)

There are very strong consequentialist reasons for acting with integrity

we should be a lot more benevolent and a lot more intensely truth-seeking than common-sense morality suggests

It concerns me a bit that when legal risk appears suddenly everyone gets very pragmatic in a way that I am not sure feels the same as integrity or truth-seeking. It feels a bit similar to how pragmatic we all were around FTX during the boom. Feels like in crises we get a bit worse at truth seeking and integrity, though I guess many communities do. (Sometimes it feels like in a crisis you get to pick just one thing and I am not convinced the thing the EA community picks is integrity or truth seekingness)

Also I don't really trust my own judgement here, but while EA may feel more decentralised, a lot of the orgs feel even more centralised around OpenPhil, which feels a bit harder to contact and is doing more work internally. This is their prerogative I guess, but still.

I am sure while being a figurehead of EA has had a lot of benefits (not all of which I guess you wanted) but I strongly sense it has had a lot of really large costs. Thank you for your work. You're a really talented communicator and networker and at this point probably a skilled board member so I hope that doesn't get lost in all this.

RobBensinger @ 2024-04-20T01:16 (+7)

There’s a knock against prediction markets, here, too. A Metaculus forecast, in March of 2022 (the end of the period when one could make forecasts on this question), gave a 1.3% chance of FTX making any default on customer funds over the year. The probability that the Metaculus forecasters would have put on the claim that FTX would default on very large numbers of customer funds, as a result of misconduct, would presumably have been lower.

Metaculus isn't a prediction market; it's just an opinion poll of people who use the Metaculus website.

Ben Millwood @ 2024-04-20T19:11 (+19)

agree with "not a prediction market" but think "just an opinion poll" undersells it; people are evaluated and rewarded on their accuracy

RobBensinger @ 2024-05-03T20:32 (+4)

Fair! That's at least a super nonstandard example of an "opinion poll".

William_MacAskill @ 2024-04-18T09:46 (+94)

How I publicly talked about Sam

Some people have asked questions about how I publicly talked about Sam, on podcasts and elsewhere. Here is a list of all the occasions I could find where I publicly talked about him. Though I had my issues with him, especially his overconfidence, overall I was excited by him. I thought he was set to do a tremendous amount of good for the world, and at the time I felt happy to convey that thought. Of course, knowing what I know now, I hate how badly I misjudged him, and hate that I at all helped improve his reputation.

Some people have claimed that I deliberately misrepresented Sam’s lifestyle. In a number of places, I said that Sam planned to give away 99% of his wealth, and in this post, in the context of discussing why I think honest signalling is good, I said, “I think the fact that Sam Bankman-Fried is a vegan and drives a Corolla is awesome, and totally the right call”. These statements represented what I believed at the time. Sam said, on multiple occasions, that he was planning to give away around 99% of his wealth, and the overall picture I had of him was highly consistent with that, so the Corolla seemed like an honest signal of his giving plans.

It’s true that the apartment complex where FTX employees, including Sam, lived, and which I visited, was extremely high-end. But, generally, Sam seemed uninterested in luxury or indulgence, especially for someone worth $20 billion at the time. As I saw it, he would usually cook dinner for himself. He was still a vegan, and I never saw him consume a non-vegan product. He dressed shabbily. He never expressed interest in luxuries. As far as I could gather, he never took a vacation, and rarely even took a full weekend off. On time off he would play chess or video games, or occasionally padel. I never saw him drink alcohol or do illegal drugs.